Casey Research publishes a variety of different investment newsletters that can supposedly make you a lot of money, but can they really?

The number of lousy newsletters out there that lead to disappointment seem to outnumber the quality ones... and with all the over-the-top sales pitches for the ones at Casey Research it worries me a bit... especially with reviews from people online saying to "stay away from this scam" and things of similar nature.

Is Casey Research a scam company that would be better off avoiding or would it be worthwhile to actually subscribe to one of their services?

This is the question I set off to answer, and in this review I'll be going over what exactly Casey Research is and what they provide, concerns, performance complaints, the refund policy, pros v cons and more.

*Don't buy into anything until you've read this!

Overview

- Company: Casey Research

- Website: CaseyResearch.com

- Founder: Doug Casey

- Offers: Investment newsletters

- Subscription Cost: $0 - $3,500/yr

What Is Casey Research?

Casey Research, in a nutshell, is an investment advisory firm that provides specific, actionable steps and recommendations to make money in stocks, bonds, currencies, real estate, and commodities via their various investment newsletter subscription services... similar to what Agora Financial, St. Paul Research & Mauldin Economics provide.

Like most of the investment recommendation services out there, Casey Research focuses on opportunities that have the potential for large profits and attempts to minimize risk as much as possible through ample research.

Most stock recommendations are undervalued, small-cap companies, which the exception of large-cap stocks recommended in their entry-level publications.

The company does have knowledgeable and experienced people behind it, but they don't have all that great of a reputation, with the BBB's C rating reflecting this... along with a number of complaints that I'll be going over later in this review.

Who Is Behind It?

Casey Research was founded by Doug Casey, a best-selling author, libertarian philosopher and someone who is well-known for being a speculator with a contrarian mindset.

Doug Casey has published a handful of books on investing, but his 1979 book titled Crisis Investing was the most notable, being a huge hit and catapulting his career, having been number one on The New York Times Non-Fiction Best Seller list in 1980 for 29 weeks straight.

Additionally, Doug has participated in debates with Presidential candidates, serviced as an economic advisor for leaders of foreign nations, and has been on CNN, NBC News, and other shows providing advice on the global market numerous times.

Besides Doug there is a small team of analysts that work at Casey Research and run the various newsletters being offered. These people include:

- Nick Giambruno

- Nick travels around the world looking for good investment opportunities and speaks at investment conferences all over. He has been featured in The Economist, Forbes, Seeking Alpha, and many other publications for his expertise.

- E.B. Tucker

- E.B. is a contrarian investor with a love for gold investments, which is probably why he helped found the KSIR Capital Management company, an investment firm focused on gold and silver.

- David Forest

- David loves to travel around the world looking for good opportunities in the commodities industry. He has a background of over 20 years as a geologist and knows what to look for when it comes to a good investment in this area.

- Marco Wutzer

- Marco is said to be an expert on digital assets and is particularly fond of the opportunity that cryptocurrencies present. He was investing in "e-gold" in the 90's and was able to get in on bitcoin as early as 2010.

Who It's For

Obviously those looking to make money investing, but more so people who worry about future financial crises and want to prepare for them financially.

One of the viewpoints of Casey Research, that you might agree with, is that the government meddles in US citizens' lives too much, and with this meddling comes consequences that are negative for most people, but have some positive upsides if you know how to manage your investments correctly... which Casey Research helps with.

Do you have contrarian views? Do you like the sound of speculative investing? Are you a republican (it's obvious this is for the Republican crowd)?

Then the services offered here might be for you.

Is Casey Research a Scam?

The company is not a scam. They do provide legitimate services that have real value.

That said, there are a lot of people calling this place a scam and for understandable reasons that we will discuss later on in the complaints section.

*Largely because of the over-hyped, misleading, and over deceptive advertising techniques used to lure in new subscribers. Such as by E.B. Tucker's "Gold Placements" teaser.

Advisory Services

1. Casey Daily Dispatch

This newsletter is sent out 6 days a week and is completely free. Chris Reilly is the chief editor here and he guides readers to some of the better money-making opportunities that exist and warns against potential threats.

As you can imagine, because this is free, a subscription here provides very basic and general information... but nonetheless it can be valuable.

Price: Free

*Note: If you subscribe to this there will be a lot of promotional upsells to get you to buy into the paid subscription services they offer.

You can read my full review of Casey Daily Dispatch here.

2. The Casey Report

This is their flagship advisory service run by chief analyst Nick Giambruno. Here subscribers are provided with broad overviews of the market and recommended mostly large-cap stocks that come with low risk... but also have low profit potential.

Every asset class is analyzed here so subscribers can be provided with various sorts of recommendations. Additionally, members will be provided with information on safeguarding wealth against threats such as government seizure and market collapse.

A 1-year subscription provides 12 issues of The Casey Report that are sent out on a monthly basis, each of which will include the latest market research, their top investment ideas, trends and more.

Doug Casey's two books, Totally Incorrect and Totally Incorrect: Volume 2 are also provided as bonuses (electronic copies).

Price: $199/yr

Read my review of The Casey Report

3. International Speculator

This newsletter was first launched by Doug Casey many years ago, but he has since brought Dave Forest on-board.

The focus here is on profiting from commodities in junior mining sector. Doug and Dave travel around the globe and meet with geologists and CEOs to find tiny resource companies with big potential.

If you subscribe to the newsletter you will get 12 monthly issues of International Speculator which includes:

- Research

- What are the best buys

- What to avoid

- Important trends

- First-hand reports from their travels

- Specific stock recommendations with information on when to buy/sell, updates and more

Subscribers will also be provided with a "free" special report called "The Nine Ps of Resource Stock Evaluation" which goes over how Doug and Dave find the junior mining stocks, what they look for, analysis, and more.

Price: $3,000/yr

4. Crisis Investing

Crisis Investing focuses on exactly what the name implies... investing in crisis opportunities.

Here Nick Giambruno takes on the contrarian view and looks for areas of crisis where there are assets that most people wouldn't want to touch with a 10 foot pole... but that have big upside. He frequently travels to far-away countries to gather information from the front-lines.

The fact of the matter is that crises sometimes come along with huge investment potential because of how beaten down the markets can get... and this is what Nick looks for.

A membership for Crisis Investing provides subscribers with:

- A monthly Crisis Briefing newsletter that provides details on the crisis that is being targeted and what investment you should get in on, as well as instructions for what the target price is that you should exit at.

- Members area access that will allow you to login and look at past briefings any time you wish.

Subscribers will also get "The Crisis Investing Owner's Manual", which is a step-by-step guide to investing in any crisis and goes over how to analyze different crisis opportunities on your own.

Price: $3,000/yr

5. Strategic Investor

This subscription service is run by E.B. Tucker and follows the strategy laid out in Doug Casey's book, Strategic Investing.

It's an entry-level subscription service so the cost is low and the information provided doesn't require as much research.

Here subscribers are provided with investment recommendations based on his 4 step strategy: 1) Assess, 2) Consolidate, 3) Position, and 4) Speculate.

A subscription to this service includes:

- Monthly issues of Strategic Investor that provide all the latest research, recommendations, target investment prices and when to exit, etc.

- Bonus reports such as "The Essential Currency for Surviving a Monetary Crisis" which goes over the currency you should invest in to survive an economic collapse (not gold or bitcoin), "The Gold Investors Guide" that provides all their trusted dealers for buying gold, and "The Cheapest Legal Way to Buy Gold in America Today" (these bonus reports change often).

Price: $199

6. Strategic Trader

This is basically the more in-depth and valuable version of Strategic Investor. Strategic Trader is also run by E.B. Tucker and here he also uses the 1) Assess, 2) Consolidate, 3) Position, 4) Speculate plan of attack.

The focus here is on profiting in times of uncertainty. E.B. Tucker has a dismal outlook on the global financial future and with Strategic Trader the goal is to navigate the upcoming uncertain times strategically to be profitable.

Subscribers to Strategic Trader get:

- The monthly Strategic Trader newsletter that goes over all of E.B.'s latest ideas for big profits.

- Updates provided as needed, usually 1-2 times a month.

- A video training series that will go over all you need to know to begin trading.

- Reports such as "The Complete Guide to the World's Most Explosive Securities" that goes over E.B.'s top picks and provides a full breakdown of his strategy + bonus reports

Price: $3,000 (discount offers available)

7. Disruptive Profits

If you are interested in cryptocurrency investing then this might be for you. Marco Wutzer runs this newsletter and he is all about investing in new blockchain projects.

Although (at the moment) the cryptocurrency market is down around the board, he is very bullish on this form of investment and claims that each recommendation he gives will provide the chance to make 300-times your money (his words, not mine).

A subscription for this service provides:

- 12 monthly issues of the Disruptive Profits newsletter where Marco will recommend a new blockchain project to invest in. A full breakdown of his research will be provided so that members know exactly what the new project's purpose is and why it's a good investment.

- Alerts & updates in real-time whenever there is any big news or action that needs to be taken.

- The Crypto Manifesto, in which Marco gives his world view and his reasoning for his obsession with cryptocurrency... and why he thinks it's such a good choice.

- A 4-part training series that goes over how to invest in cryptocurrencies.

Price: $3,500/yr

8. Casey Platinum

This is the tippidy top of the iceberg and is a membership that includes 'nearly" everything that they publish.

With a lifetime Casey Platinum membership one gets a lifetime membership to:

- Crisis Investing

- International Speculator

- Strategic Trader

- Disruptive Profits

- The Casey Report

- Strategic Investor

Obviously this membership isn't for the average person. It is for someone who wants to put their hands in everything and has a lot of free-time available.

Price: Not disclosed (have to call to get a quote)

Cost & Refunds

The costs vary a lot, as you have seen... anywhere from $0 - $3,500/yr.

The major differences in price are directly due to the major differences in value. For example, The Casey Report ($199/yr), which is their flagship low-cost newsletter that provides relatively safe investment advice for large-cap stocks, cannot be compared to International Speculator ($3,000/yr), which requires Doug & Dave to travel the world looking for big opportunities in the junior mining sector... a lot more work and value provided.

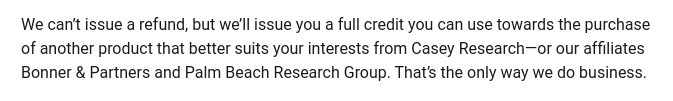

Refunds, for the most part, don't exist here.

Full refunds are only available for The Casey Report ($199/yr) and Strategic Investor ($199/yr)... their low-cost newsletter services. Subscribers can request a refund within 60 days and get 100% of their money back if they do not like what they were given.

However, all of the other subscriptions don't allow refunds. Instead, they give you 90 days to decide if it is right for you, and, if you decide you don't like what you got, they will give you credit towards another service, whether it be theirs or one of their affiliates'...

*Note: Subscriptions will automatically be renewed every year unless cancelled.

To get a refund or a credit towards another service, call the customer support team at:

- 1.888.512.2739

- or submit a support ticket on their Contact Page

Performance

As for the performance of the various publications at Casey Research... well... there isn't any clear track record.

If you become a member you will get access to the model portforlios and can go through past recommendations to see how things performed, but there is nothing you can see without becoming a member.

All we know is, for the most part, what is stated in the promotional material, which of course only consists of the best recommendations they have made and leaves out all the losers.

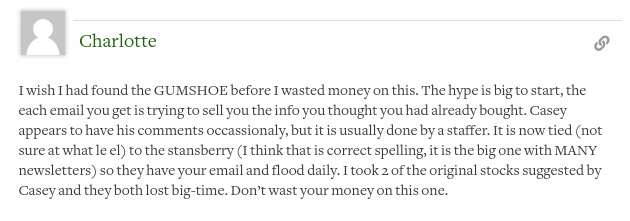

However, after doing some digging around I have been able to pull up quite a bit of complaints from people losing money on the recommendations give, such as this review left on Stock Gumshoe about The Casey Report in which they claim 2 of the original stock recommendations "lost big-time"...

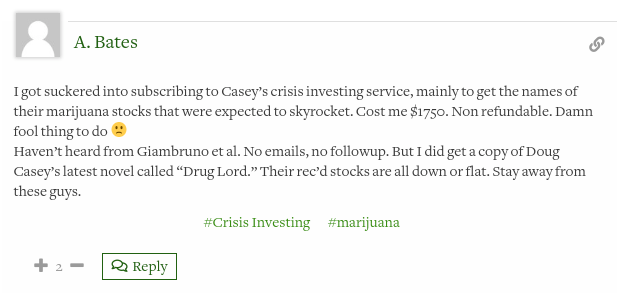

And then another in a review of Crisis Investing (also from Stock Gumshoe) that states "their rec'd stocks are all down or flat"...

And the review of The Casey Report from Stock Gumshoe shown below is from someone who spent quite a lot of time reviewing past recommendations and found that those given by The Casey Report performed worse than the S & P 500...

Now of course results are going to vary greatly depending on what publication you subscribe to.

And, while I'm sure the winners shown in the sales material are true, I think we can all agree that the sales pitches are misleading. They make it seem as if the different services offered are sure to make you rich... which it seems could be far from the truth based on the reviews I've found.

*If any members want to provide a more clear track record, please leave a comment below this post.

Concerns

With investment recommendation advisory services like this there is always the concern of "pump & dump".

Unlike other investment advisory firms that restrict their staff from investing in recommendations before they are provided to subscribers, like The Oxford Club for example (review here), Casey Research has no such policy in place.

Now I'm definitely not saying that the advisors are making big money off of giving recommendations and pumping the stock prices, but this is a real concern and hopefully we can trust them not to do this.

The fact that there are some complaints I've found accusing the company of doing exactly this isn't very settling however...

*This review was a few years old however... not that it makes it any less valid.

Customer Reviews/Complaints

The overall ratings for the company, based on review sites online, aren't looking too good.

- C+ rating with the BBB and a number of complaints to go along with it

- 1 out of 5 star rating on SiteJabber (1 review) with claims of it being one big pump & dump company

- And low ratings for the individually rated newsletters they offer on Stock Gumshoe... with lots of complaints

Some of the more common complaints against this company that are worth noting include:

Losing Recommendations

As you've just seen, there is risk involved and not all of their recommendations will be winners. And, as expected, people complain about this.

However, while there are many valid complaints from people who are upset after losing money, you have to keep in mind that people are more likely to leave reviews when something negative happens rather than when there is a positive outcome... so reading complaints can at times be misleading.

The Refund Policy Sucks

I don't understand why they don't give out refunds for the more expensive subscription services. I understand that customers receive value right away from the service, but at the very least they should provide a pro-rated refund or something. After all, these services are completely provided digitally so there wouldn't even be anything to return... making the refund process as easy as it can be.

Lack of Transparency

It seems that with investment subscription services, like those that Casey Research provides, talking about all the winning recommendations and conveniently leaving out details about the losers has become the norm. A clear track record of performance would be nice... but no such thing is available.

Misleading Promotions

Casey Research, unfortunately, falls into the same category as other companies like Agora Financial & Money Map Press when it comes to their deceptive advertising tactics.

The excerpt shown below from a review on dirtyscam.com sums it up nicely...

They use the typical "sky is falling" fear-mongering approach to lure in new subscribers by scaring them into thinking that they world is coming to an end.

Often the sales pitches are loosely based on fact and very-misleading, like that of Cannabis Lots opportunity I recently reviewed... not the straight-forward, honest type of information we'd like to see.

*Note: In the review above there is also the mention of pump & dump stock promotion... adding to the concern mentioned above.

Unauthorized Charges & Billing Problems

There are quite a few complaints with the BBB on billing problems... people having trouble canceling their subscriptions, being charged for things they claim they didn't agree to, etc.

It seems that the customer support Casey Research offers is pretty horrendous. But as for the complaints about unauthorized charges... this is likely due to the sneaky sales tactics employed by the company in which people are lured into subscribing to things in tricky ways.

Take for example this review, which is from someone who got tricked into a subscription after ordering a book...

[Source: Stock Gumshoe]

Promotional Bombardment

If you join their services it seems you should prepare your email inbox for the bombardment of promotions that are likely to come your way.

Additionally, their newsletters often contain subtle sales-pitches to get readers to buy into their other services.

For a more detailed look at some of the top complaints, you can read this post.

Pros v Cons

Pros

- Follow-along style investment advice where no experience is needed (definitely not saying you should blindly follow their advice though!)

- A lot of time & effort put into their research (traveling the globe, meeting company leaders... lots of front-line efforts)

- Knowledgeable advisors

Cons

- Lack of transparency

- Tricky marketing tactics

- Risk involved (as with any investment opportunity)

- Pricey subscriptions (some of them)

- Company's reputation not that great

Conclusion - Worth Joining?

Are any of the newsletter services at Casey Research worth subscribing to?

Well, this is an incredibly difficult question to answer because we don't have clear track records as to how well their recommendations have performed. But with all of the complaints, some stating that as much as 90% lose money, and with the fact that they are engaged in deceptive and scammy advertising techniques... I will not be recommending this company to my readers personally. But you can decide for yourself whether to join.

Unfortunately it seems that misleading sales tactics and the use of fear-mongering have become increasingly popular when it comes to selling investment subscriptions like those offered by C.R.

I hope you enjoyed this review and found it helpful... and if so... please share this post to help out my website.

PS: You can take a look at an investment advisory service with a proven track-record that I actually recommend HERE.

Now it's your turn: What is your opinion of Casey Research? Leave your comments below this post!

Great article, Kyle! I really appreciate your candor, and and the straightforward approach you have at explaining things to the average investor. I learned of Casey Research through a long-winded report by E B Tucker, which came from another long-winded report from The Wolf. I now see how these people/companies make their money!!

Kyle, thanks to you, I feel that I will be making a good decision in avoiding this “life-changing opportunity” and continue doing my due diligence in finding those worthy stocks that may prove to be good investments. Again, thank you so much!

I’m glad I could help Sandy. Keep doing your own due diligence. That’s always important.

Excellent review Kyle! I read every word. Thanks and I agree with your assessment.

Question:

Do you have any investor sites that you would recommend? Which one do you really use, if any?

Hi Jorge. Thanks you. I’m glad you liked it. One of the few sites I recommend is Motley Fool. They provide good advice. Their Stock Advisory newsletter service is also something I recommend if you want to be provided with specific recommendations regularly.

Did you ever ask yourself why they are selling recommendations rather than following them?

Hi Kyle, Please comment and advise on the following: I received an e-mail from Casey etc….who used the fear technique to sell books about the coming “end of the world as we know it” theory that the democrats and major international companies (including Disney, Morgan Stanley, McDonalds, Starbucks, the UN, Federal Reserve et al) were planning to force Americans to give up all but a maximum of $5000. of their money to the government (to allegedly gain control over the people and to make up for the trillions of dollars the US has in deficit. Allegedly this is the socialist way to digitally monitor Americans via a so called body Chip insert and a bank card that the government can arbitrarilly add to or subtract from at their will. This is because the government wants to replace our monetary system by forcing everyone to give the government all their money- go cashless, and allow the government to monitor and steal each individual’s money in banks, credit unions, retirement accounts, CD’s etc. Do you have any knowledge about such plans…or possibilities….and id so, what might be a time frame for such a

take-over. They suggested it will be the 4th? time in US history that such a monetary take-over will have occurred. Will we really be forced to go cashless? Thank you for any feedback.

For the Republican crowd : What a DICK you are.

I found your review to be thoughtful up until the time that you wanted to try and slam Republicans. You just come off as another bitter Dem. Too bad, really.

Actually Sean, I’m not a Dem.

Me too I think I will stay away. I just listened to David Forest giving a whole monologue about how the economy is coming to an end, and in just four years we will look like Venezuela and be standing in line for bread. I was almost going to subscribe, but then I read your article saying that they’re known for their fear mongering techniques, I think I’d rather stay away. Seems a bit scammy to me, although he might be right on some points.

I have been a subscriber for 3-4 years. I do find C.R. to be a bit “blah” but really like the crisis investing newsletter. I’ve actually made some serious money on several of their recommendations – I’d say 4-5 doubles and 1-2 10X in the last 3-4 years but, as with any speculative investment, I’ve also lost ~80+% on some. I continue to hold even those big losers because I still believe the premise explained in the initial recommendation and the letter hasn’t recommend selling them. I’ve done some tracking and I’d guess I’m returning a bit less than 10% per annum which isn’t too bad, but, I actually expect several of those I hold to outperform in coming years.

But, it’s all very speculative. not for everyone and you will frequently lose money in the short term. I find the actual newsletter to be pretty good, yes many of the complaints are valid – they spend a lot of text talking about how good some of their recommends have been but they do have to fill a whole letter each time. Not an excuse but imagine if they said “we have nothing this month”.

I also find the 6X/week emails annoying and they are frequently upselling. I’ve asked them to unsubscribe but then I’ll lose the more interesting ones – I appreciate their perspective on many topics, I just wish I could get away from the crossell/upsell.

I was trying to research the Casey Research and found your site. Really appreciate the review. After listening to their pitch and then the bombardment, I decided it isn’t such a great site. Thanks.

I was looking for some beginners tools on the crypto market. So any recommendations are good.

Thank you for this website, Kyle. I was just about to subscribe to Strategic Investor but felt in my gut something wasn’t “right”. If you do have reliable information on how to invest in Warrants and education on how to determine which ones have potential for strong returns, I’d love to learn more.

A sane analysis Kyle! Thank you. I check gumshoe, nerdwallet, BBB (useful only if the company is a member). Re unauthorized charges: I rarely if ever use credit card, only Paypal, or I ask for their address (so I can verify) and even then, only by bank bill pay. If they don’t give an address I walk away.

Good, candid and thorough review. Thanks for helping us wade through all the information out there and in helping us make informed decisions.

Thanks for your review. I take everything I hear and see on the internet with a grain of salt. Your review appears to be balanced and objective and I do appreciate that. As for the Casey Report, it seems like a crap shoot and I personally am not willing to invest that much time for something so questionable.