Is there a scam going on with Jim Fink at InvestingDaily? Or can you trust his investment recommendations and the claims he makes?

Jim Fink Investing Daily scam or Jim Find Investing Daily miracle... which is it?

There have been some people asking this so I decided to do a little investigating and see whether or not he is legit.

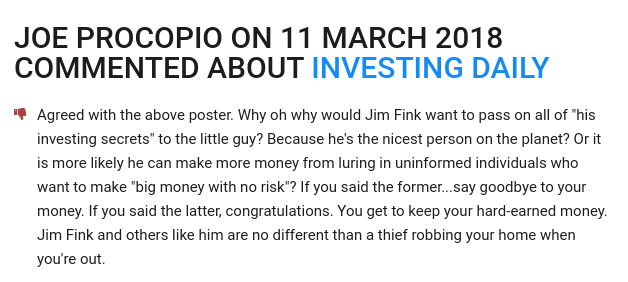

Upon first looking around online I came across quite a few very negative reviews, such as this review on RepDigger where someone compares him to a "thief robbing your home"...

There is a whole slew of negative reviews out there, and it's definitely unsettling.

Another I came across stated that you should "Stay away from InvestingDaily and anyone associated with them. RUN AWAY."

But is Jim Fink and InvestingDaily really that bad?

Well, let's first start by going over who the guy is in the first place.

Who Is Jim Fink?

[Source: Business Insider]

Jim Fink works for Investing Daily (InvestingDaily.com), an investment advisory firm, as an investment strategist and analyst. In a nutshell, what he does is provides trade recommendations to subscribers of his different advisory services so that they can follow along without any needed experience or knowledge, specifically in the realm of options trading. He tells people what to invest in and when to invest, similar to a lot of other trading advisory services out there, such as Strategic Trader, The Casey Report and many others.

Background

Jim has quite the educational background. He has a bachelor's degree from Yale, a master's degree from Harvard's Kennedy School of Government, a law degree from Columbia University, and a MBA from University of Virginia's Darden School of Business... quite a lot.

Prior to getting involved in investing and prior to his degree in business, Jim worked in telecommunications regulatory law for 9 years. However, the pay wasn't good enough for him and he found that investing was a better choice financially.

To-date he has more than 20 years of options trading under his belt and has supposedly made profits of over $5 million for himself.

Currently he works for InvestingDaily as an analyst/strategist, but used to work for Motley Fool for a brief period of time, as I found out on his LinkedIn profile.

Trading Services

Currently Jim is the chief investment strategist for the Options for Income and Velocity Trader, as well as an investment analyst for Personal Finance... all of which are services offered by InvestingDaily.

Options for Income - $3,000/yr

This service, as the name suggests, is all about trading options. Here Jim tells subscribers what to invest in and when to invest. It is advertised as "conservative options for aggressive income".

A subscription includes:

- 4-6 trade recommendations per month

- Alerts on when to enter/exit a trade

- Access to the "Stock Talk" message board where you can personally ask Jim questions

- Video trading series where Jim goes over his strategies and provides beginner information on trading options

Velocity Trader - $3,000/yr

Velocity Trader is another options trading recommendation service by Jim, but it works a bit differently in terms of strategy and the way the information is laid out. This is built around his Velocity Profit Multiplier system, which finds good stocks based on 5 signals that they send out before moving.

Members get access to:

- 52 weekly issues with 2 trade recommendations in each along with Jim's market analysis and charts

- Velocity Trader bootcamp that is an 8-part training series which goes over the basics of options trading

- Access to the forum where you can ask questions and get answers

Personal Finance - $99/yr

Personal Finance is InvestingDaily's flagship entry-level newsletter. It has been around for over 40 years and has a broad focus, providing subscribers with broad-level market analysis, recommendations for growth accounts, retirement, options trading, etc.

As a subscriber you get access to:

- 12 newsletter issues per year that include market analysis and trends, along with any important updates on the model portfolios

- Alerts to any breaking news or opportunities that become available

- Members area access, which includes access to the database of past issues, special reports released, etc

- Access to the Stock Talk message board

Reviews - Not Looking Good

After doing a lot of digging around online I haven't been able to come across all that many good sources of reviews for Jim's advisory services. However, I have found some... and overall the ratings aren't too pretty.

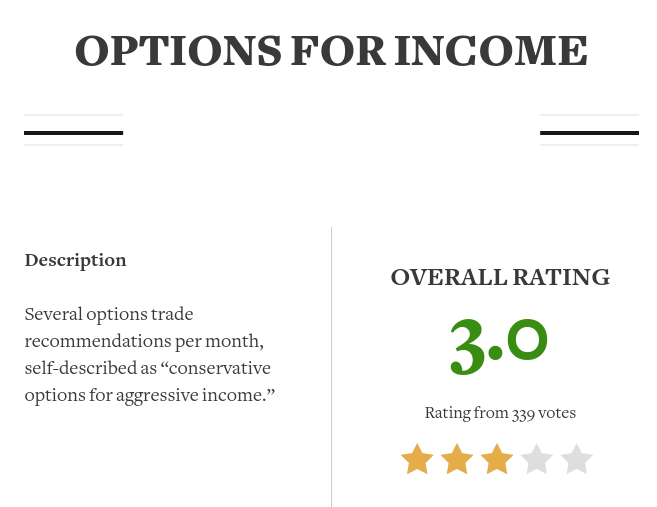

Options for Income Reviews

Stock Gumshoe is one of the best sources of independent subscriber reviews I have found... and there are quite a bit of negative Options for Income reviews on StockGumshoe.

The overall rating is 3 out of 5 stars, not too bad, but you'll see what I'm talking about when I say things "aren't too pretty".

[Source: Stock Gumshoe]

When it comes to advisory services like these, the number 1 goal is profitability. Unfortunately, it seems that a lot of subscribers are in the red here.

With Options for Income some people claim to have lost substantial amounts of money following Jim's recommendations, but of course you won't hear about this in the promotional material.

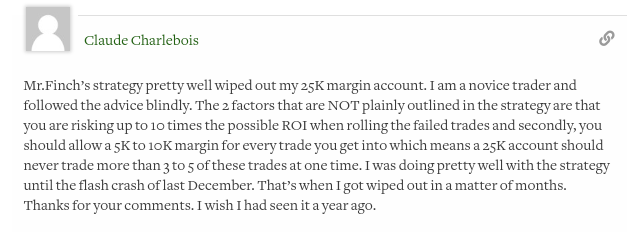

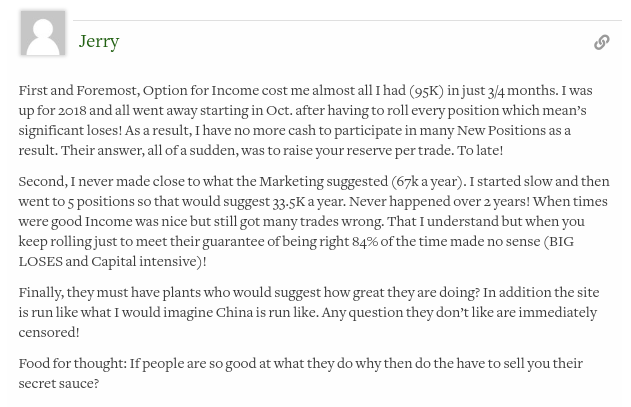

Below are reviews from Stock Gumshoe...

[Source: Stock Gumshoe]

[Source: Stock Gumshoe]

[Source: Stock Gumshoe]

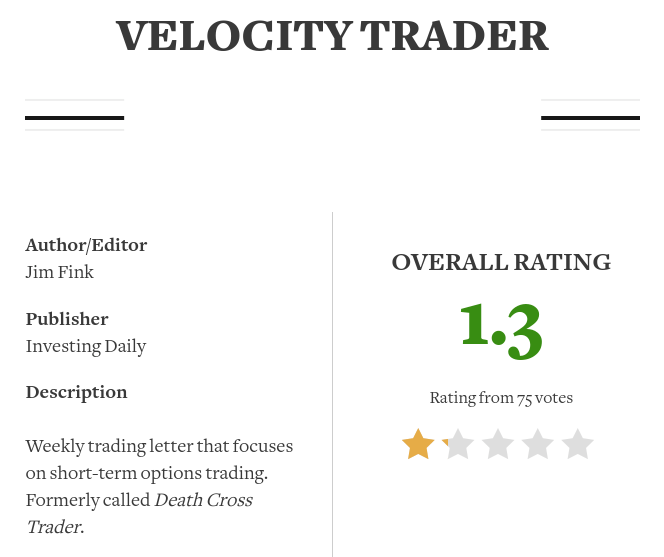

Velocity Trader Reviews

And if you were hoping that reviews for Velocity Trader would be better than you thought wrong. The reviews on Stock Gumshoe are worse overall, which a 1.3 out of 5 star rating...

[Source: Stock Gumshoe]

To go along with the low rating are plenty of negative reviews... again with some people losing significant amounts of money following the recommendations given.

Here are a few examples...

[Source: Stock Gumshoe]

[Source: Stock Gumshoe]

[Source: Stock Gumshoe]

Apparently Velocity Trader used to be called Death Cross Trader, but it was doing so poorly and getting so many bad reviews that this is likely the reason it was renamed.

But low ratings are sometimes normal..

It is true that people are more likely to leave negative reviews after bad experiences rather than positive reviews after good experiences, and it is also true that there are some good reviews out there for Jim's services... HOWEVER, the bad far outweigh the good here and the good reviews are few and far in-between.

There is even a profile for Jim Fink and InvestingDaily on DirtyScam, where it has an extremely low rating, as expected...

Misleading Promotions

One of the big problems with Jim Fink's services is the way in which they are promoted, which can be very misleading. In short, the way they are promoted basically makes them seem like sure-fire ways to get rich, which as you have seen from the reviews above can be far from the truth.

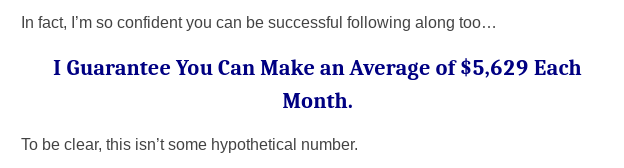

For example, here is snippet from a promotion for Options for Income...

In this promotion Jim specifically states that he guarantees you can "make an average of $5,629 each month".

Now how can he possibly have any idea what any subscriber can make when he has no idea how much money one has to start out with? It's impossible... and a very misleading claim.

And there are plenty more misleading claims where this came from.

Investing Daily Agrees to Modify Advertising Claims

The Electronic Retail Self-Regulation Program (ERSP), administered by the BBB, contacted InvestingDaily in early 2019 and asked them to discontinue some of their misleading advertising pitches.

Some of the misleading claims that ERSP wanted them to change (which you can read more about in this article) included:

- “Give me 9 minutes a week and I guarantee you $67,548 a year.”

- “Look how easy it is to collect thousands of dollars in ‘free money’ every month.”

- “And that’s why selling options is about the closest you can get to never losing money investing.”

- “I ended the year with a cash-flow well over $100,000… which is just plain unbelievable.” –Roger D., Wayzata, MN.

They claimed they would, and supposedly did to some extent, but obviously this wasn't enough because they are still using some pretty darn misleading claims in my opinion.

An 85%+ Win Rate??

There are some promotions floating around the internet where Jim brags about his 85% win record, which is quite a bold claim to make (specifically for his Options for Income service).

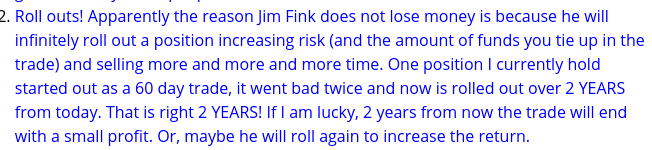

And yes, it does seem that he actually has a 85% win record... HOWEVER, this isn't as it seems.

Upon looking further into this I found that the reason he doesn't lose trades is because he keeps rolling them out if they go bad, investing more and more capital, as mentioned in a review at UnderpaidOverworked.com that I found...

And as also mentioned in another review I found on Stock Gumshoe...

Now this method is okay if you have large sums of capital that you can tie up in trades that may take years to come out of... but for the average subscriber buying into this kind of service it is definitely NOT realistic and will lead to losses.

It would be nice if there was more information provided on this kind of thing beforehand, but I guess most people find out after getting into a bad trade and losing money.

Conclusion - Trustworthy Fellow or Not?

You can form your own conclusion on whether or not to trust Jim Fink. I think we can all agree that the marketing coming from him and InvestingDaily for his trading services is rather ridiculous however.

Unfortunately, just like Agora Financial, St. Paul Research, Raging Bull, and other investment advisory firms, InvestingDaily and the team (which includes Jim Fink) have fell victim to the lure of easy money by promoting their services as better than they really are just to make some extra money off of unsuspecting individuals who buy into the hype.

So anyways... the takeaway here is that you should definitely NOT believe everything the sales material says and you should always do some additional research. Jim Fink isn't the straight-forward/honest salesman that we would like to see, but there is no doubt he is an educated man who knows what he is doing... although his recommendations don't seem to pan-out all that well.

I hope you enjoyed this review and found it helpful. If you have any comments or questions, please leave them below 🙂

Thanks for the review. It’s going to save me a lot of losses avoiding this guy

Hi Brian.

Always happy to help!

Thank you for the detailed information and review. Stay well.

Im not sure how you gather all this info, I had a harder time finding reviews. So I appreciate this a lot! Not looking for get rich scheme but just some sound advice on investing and understanding technicals etc so still looking. Thanks again, Cheryle

Investing Daily is a scam, bought their newsletter, none of the picks worked out

Thank you for the review. I believe I will avoid Jim Fink based on on your research.

Dave Kyser