You may be hesitant to subscribe to their services. There are many shady investment subscription services out there, but is The Oxford Club one of them?

Is The Oxford Club a scam you would be better off avoiding or is this place a worthwhile investment?

In this review I'll be going over just about all there is to know about it so that you know exactly what you are potentially getting involved with.

The Oxford Club Review

- Name: The Oxford Club

- Type: Financial newsletter service (and more)

- Website: oxfordclub.com

- Cost to Join: Varies greatly depending on subscription

- Legit?: Yes

The Oxford Club is (mainly) a financial newsletter service headquartered in Baltimore, Maryland. It provides a variety of different subscription based services for opportunities to beat the stock market and bring in high returns on investments.

The company is said to be on of the longest running financial newsletters of it's kind and has been around over 30 years--first starting out in all-print newsletters and since evolving to provide electronic newsletter services that can be managed completely online.

According to Wikipedia the club now has more than 80,000 members in over 100 countries around the world.

Is The Oxford Club a Scam?

The Oxford Club is not a scam.

However, this service has been involved (and still is) in somewhat misleading promotions in the past, including bold, vague, and somewhat ridiculous claims in order to get new subscribers.

Upon looking into the company further I was able to find out that this place is actually owned by a much larger company called The Agora, which was founded back in 1978 by Bill Bonner.

Why do I bring this up? Well, because The Agora is also the parent company of Agora Financial, Stansberry Research, Banyan Hill Publishing, Money Map Press--all of which have a fairly bad reputation for unethical marketing tactics--along with others. That said, each company is independently operated, but it's interesting that so many of them are so similar with their misleading marketing tactics.

Is The Oxford Club Legit?

The company is legitimate and does provide a legitimate service.

While there are many claims of them being a scam, there are also many subscribers that are more than happy with their services.

What They Have to Offer: Newsletters and VIP Trading Services

The Oxford Club has a variety of newsletter and VIP trading services. The newsletters are the much cheaper options but don't provide you with quite as much information or guidance--and if you are a subscriber of any of the 3 newsletters offered then you will likely be hit with some promotional emails and whatnot for their more expensive VIP services.

Newsletters

Each of the 3 newsletters has 3 different subscription types that you can choose from:

- Basic Subscription for $49/yr - This is the bare bones subscription but provides you with everything you need. You get digital-only reports and also some of the premium bonuses usually.

- Premium Subscription for $79-99/yr - This includes digital and print reports along with more bonuses and sometimes even books written by the chief editors. These are shown as being normally priced at over $200 with a huge discount, but this is likely just a marketing stunt.

- Standard Subscription for $129/yr - This includes digital and print reports along with bonuses, however it includes less than the Premium Subscription and costs more, so no one ever purchases this (again, likely just a marketing stunt).

The three different newsletters offered by TOC are as follows...

The Oxford Communique - This is considered their 'flagship' newsletter and is their most popular. It is put together by the chief investment strategist Alexander Green and has received a lot of attention over the years--even being ranked by Hulbert Financial Digest as one of the top-performing investment newsletters nationwide for 15 years.

Besides this newsletter, Alexander is a best-selling author of investment books such as The Gone Fishin' Portfolio and Beyond Wealth, and is chief editor of other newsletters like The True Value Alert and The Insider Alert. He has over 20 years of experience as a research analyst, investment adviser and managing portfolios.

This particular newsletter is often promoted as providing a "single stock retirement plan"--information on some amazing opportunity that is an added bonus if you subscribe to the newsletter.

The newsletters itself is laid out like pretty much every other financial newsletter out there. You get:

- Monthly Newsletter

- This is where Mr Green really dives deep into his new recommendation of whatever stock he thinks has potential to really explode. You will get an in-depth analysis of the particular opportunity and why it's a good choice.

- Weekly Updates

- Weekly you get updated on the recommendations and where the market is at.

- Alerts

- If something takes a turn for the worse or an amazing opportunity opens up that cannot wait, you will get an alert.

- Model Portfolio

- You will be able to access the model portfolio featuring Green's recommendations to see how everything is performing.

The Oxford Income Letter - This newsletter is from the chief editor Marc Lichtenfeld who has been a trader, senior analyst and fund manager with expertise in the biotech sector. His portfolios has outperformed the S&P 500 and the S&P Healthcare Index by wide margins and this performance has landed him on CNBC, Fox News Business, in the WSJ and more.

The main focus of this newsletter is using his 10-11-12 step approach to make money with dividends, although not the only focus here.

The core of what you get with a subscription includes:

- Monthly Issues

- The monthly newsletters that are sent out are the meat of what you get here. These will have in-depth analyses of new opportunities, keep you updated on the recommended portfolios and so on.

- Weekly Issues

- Weekly you will be sent updates on the recommendations made.

- Income 'Blasts'

- These are alerts sent out that are considered urgent and can't wait to be included in the weekly or monthly issues.

- Model Portfolio

- You will also get to check out the model portfolio for his recommendations here to see how things are performing.

Strategic Trends Investor - As the name suggests, this newsletter is all about identifying patterns and trends so that you can jump in on good opportunities before they go mainstream.

The newsletter comes from Matthew Carr, emerging trends specialist, and David Fessler, infrastructure specialist.

Matthew Carr is a very busy guy when it comes to his newsletters. He is also the chief editor of The VIPER Alert, Dynamic Fortunes, Trailblazer Pro and Profit Trends.

It doesn't seem that this newsletter provides the normal monthly issues, weekly issues and email alerts like the others.

One of the main promotions going on right now to subscribe for this is to get the chance to receive "China Payback Checks", which is the opportunity to invest in companies that have potential to receive a lot of money flowing in from China to US companies.

VIP Trading Services

There are 13 different VIP trading services available in a range of different fields. Some are focused on penny stocks, others on undervalued quality stocks, some on identifying patterns and more.

*These are usually priced at $4,000 for a year subscription but some are more than this (expensive I know).

- Automatic Trading Millionaire

- Chief Editor: Karim Rahemtulla

- Focus: Buying stocks at a "discount"

- Price: $4,000/yr

- Chairman's Circle Breakout Alert

- Chief Editor: Marc Lichtenfeld

- Focus: Recognizing chart patterns (specifically the bull-flag pattern) & trading from them

- Price: Not listed (have to call VIP Trading Services at 888-570-9830 or 443-353-4537 for international callers)

- Fessler's Flash Profits

- Chief Editor: David Fessler

- Focus: Using David Fessler's proprietary trading formula to target good plays

- Price: "just" $5,000/yr

- The Insider Alert

- Chief Editor: Alexander Green

- Focus: Following the investment moves of 'big money' for the 'insider' advantage

- Price: $4,000/yr

- Lightning Trend Trader

- Chief Editor: Marc Lichtenfeld

- Focus: Identifying catalysts that cause biotech stocks to surge in price & jumping in on the opportunities

- Price: $4,000/yr (second year free)

- Marc Lichtenfeld's Stock Sequence Trader

- Chief Editor: Marc Lichtenfeld

- Focus: Like his VIP trading service above, the focus here is also on getting in on opportunities before catalysts hit that send prices up

- Price: $4,000/yr

- Matthew Carr's Dynamic Fortunes

- Chief Editor: Matthew Carr

- Focus: Trading based on Matthew Carr's "profit launch windows" rather than buy-and-hold strategies

- Price: $4,000/yr (second year free)

- Matthew Carr's Trailblazer Pro

- Chief Editor: Matthew Carr

- Focus: Buying penny stocks in emerging industries (lot of focus on penny pot stocks right now)

- Price: $4,000/yr

- The Momentum Alert

- Chief Editor: Alexander Green

- Focus: Trading quality stocks that outperform competitors

- Price: $4,000/yr

- Oxford Bond Advantage

- Chief Editor: Steve McDonald

- Focus: Making short-term play in the bond market

- Price: $4,000

- Oxford Wealth Accelerator

- Chief Editor: Nicholas Vardy

- Focus: Using Nicholas' ETF trading system to get in on fast moving trends in the world of ETFs

- Price: $4,000/yr

- The True Value Alert

- Chief Editor: Alexander Green

- Focus: Buying good stocks at under-valued prices

- Price: $4,000/yr

- The VIPER Alert

- Chief Editor: Matthew Car

- Focus: Getting in on stocks that have potential for big short-term gains

- Price: $4,000/yr

The Pillars of Wealth System

In addition to being able to follow along with recommendations from the expert services that TOC offers, they also provide some guidance for individuals looking to go at it alone.

The "pillars of wealth system" is a strategy taught to minimize risk and maximize potential gains--and it goes as follows...

- Stick to the Oxford Wealth Pyramid - What they mean here is that you should follow the asset allocation model they suggest so that your portfolio is diversified among different asset classes.

- Have an Exit Strategy - Of course this is always important. You have to have some strategy to avoid emotional decisions.

- Understand Position Size - If you follow the position-sizing formula that they use then you will never risk too much of your portfolio on one position.

- Minimize Investment Expenses and Taxes - Minimizing fees and taxes is something else they will show you.

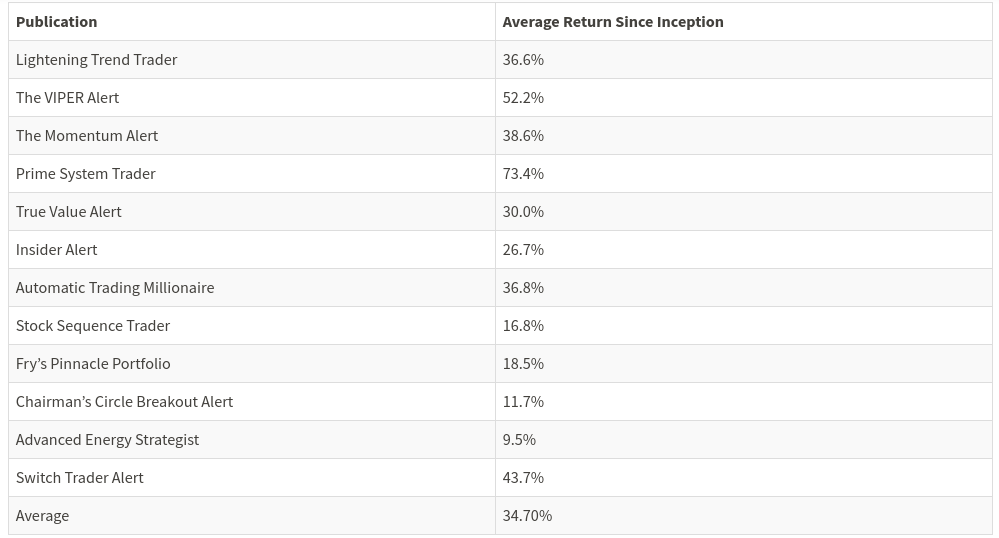

Average Returns on Recommendations

Of course everyone would like to know the historical statistics of past recommendations made by the experts at TOC.

Do their model portfolios really outperform the market and give you a chance of making big gains?

Well, according to The Oxford Club themselves (I know, not the most reliable source), they provide some pretty high average returns, as you can see from the chart below (this chart is a bit outdated and not all of the publications are still around)...

Source: oxfordclub.com

If true then this is pretty darn good. An average return of 34.70%??

However, this chart shows nothing for the newsletter services (The Oxford Communique, The Oxford Income Letter, & Strategic Trends Investor).

There isn't really all that much information showing good statistics for overall performance of the newsletters out there. Sure, there are people writing reviews and talking about how they made this % from this investment or complaining about losing money from an investment, but nothing that gives us the big picture.

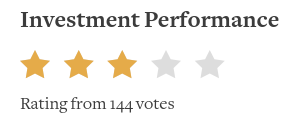

That said, each of these newsletters is listed on Stock Gumshoe and is able to be rated by subscribers.

The Oxford Communique (at the time of writing this) has 144 votes and an average rating of 3 out of 5 stars for investment performance:

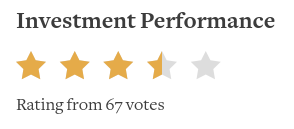

The Oxford Income Letter has an average rating of 3.5 out of 5 stars for investment performance with about 70 votes:

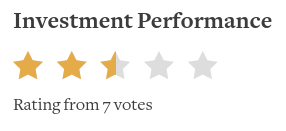

And Strategic Trends Investor has an average rating of 2.5 out of 5 stars for investment performance but there are hardly any votes to go off of here...

Other Member Benefits

Besides the core of what TOC offers, which is investment advice via newsletter and VIP trading services, they go above and beyond in some ways by providing a variety of other services/events such as the following.

*Many (but not all) of these benefits you will get no matter what service you are a subscriber of.

Annual Investment U Conference

Every spring they hold an Annual Investment U Conference in which they bring a bunch of top market analysts together to bring members some of the most up-to-date information in the investing world. Members will also get the chance to speak to experts directly (although probably not for long) as well as talk and network with other like-minded members.

These meetings are held at 5-star venues all over and members will be able to enjoy a discount as they stay.

Private Seminars

At the private seminars they hold you will be able to get the inside scoop from some of their investment strategists, strategists like Alexander Green, Marc Lichtenfeld, Matthew Carr, and others.

These seem to be very similar to the annual conference that they hold just that the private seminars aren't quite as large of events and are with speakers from the team at The Oxford Club themselves.

Financial Discovery Tours

These 'financial discovery tours' that they offer are for those who like to travel... and travel in luxury.

In a nutshell they are excursions that TOC has put together that could include traveling on a yacht in some exotic destination, exploring ancient ruins, being treated to a 5-star meal at a historic restaurant, etc.--where members can interact and talk about investing while enjoying life.

Chairman's Circle Cruise

This benefit isn't for the average member but is instead reserved for the chairmen at TOC.

Here chairmen are able to enjoy a luxury cruise with other top members and investment experts, which really gives you a lot of time to speak directly with people and really get to know them.

Beyond Wealth Series

These consist of meetings and, as the name suggests, these go 'beyond wealth'--with a particular focus on luxury travel and creating a life so that you can do it all the time.

Subscriber Reviews & Complaints

This is going to be a fairly lengthy section because, well, there is a lot to talk about--lots of complaints I'll be going over and a fair amount of positive reviews as well.

Reviews on Facebook

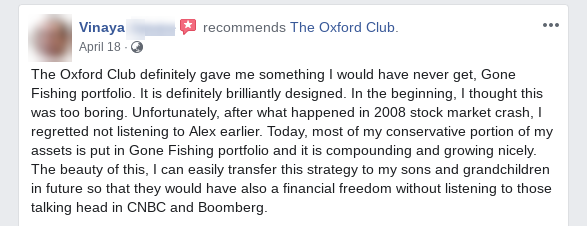

On The Oxford Club Facebook page they have an average rating of 3.9 out of 5, which in my opinion is fairly good, but definitely not great.

There are people who have left some very positive reviews about how valuable the information provided in the newsletters is...

*Note: The person above mentions that they were asked to share their review so it might not be the best to go off of.

You also have reviews from people who have had good portfolio growth due to the advice provided and are very pleased with the service...

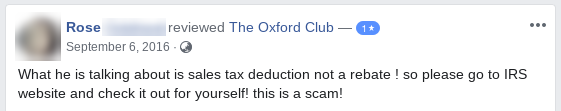

But then you have some very negative reviews from people calling it a big scam, like this one for example...

I don't know all the details behind the complaint above, but it seems that there was some sort of misleading marketing pitch about getting some 'rebate' that was really just a tax deduction.

BBB Reviews

Unfortunately at the time of me writing this review it states on the BBB's website that "this business profile is being updated", so I am unable to see any information regarding The Oxford Club, including reviews from subscribers.

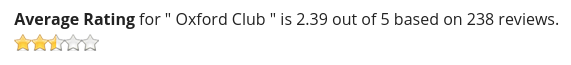

Opportunity Checker Reviews

Opportunity Checker is a website that reviews opportunities and allows for people to leave independent reviews/ratings of their own. It is one of the best sources of subscriber reviews I've found on The Oxford Club.

With around 250 reviews to date, The Oxford Club has an average rating of 2.39 out of 5 stars--not horrible but not good either.

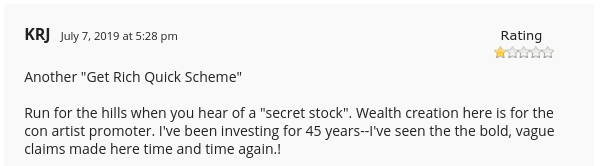

Of course you have some people calling it a 'get rich quick scheme' (which mostly comes from the shady marketing tactics used to promote the various newsletter services offered)...

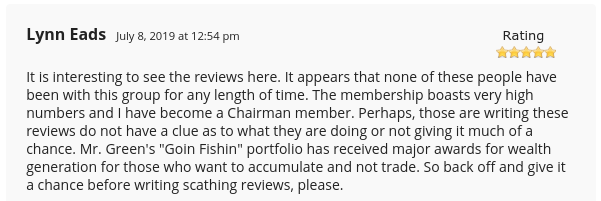

But then you have people strongly defending the service provided with a lot better of an argument than those simply calling it a scam the first chance they get...

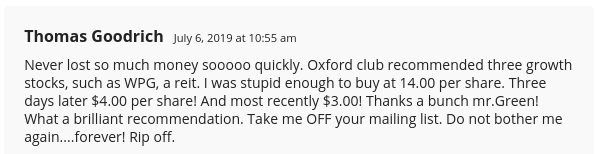

That said, there is always risk involved and there are a lot of people that do lose money from the investment advice given, such as this guy who was quite upset with his results...

However, every seasoned investor knows that there are ups and downs. So while a stock may go down short-term, in the long run it could still be a worthwhile investment, which could make the complaint above invalid.

Other Reviews

StockGumshoe can also be a pretty good source of independent reviews at times. I found quite a bit on here, but not for the company as a whole, rather for the different subscription services offered.

For reviews of The Communique newsletter that they offer there are close to 500 votes with an overall rating of 3.4 out of 5.

Overall the reviews are pretty good and you have a lot of people happy with their investments. There are some that complain about investments that didn't go as planned and being charged for a subscription they canceled, but nothing all that alarming.

The Main Causes of Negative Reviews/Complaints

Based on my observations the majority of negative reviews out there are coming from a couple different areas...

1) People Who Lost Money - Of course those who lose money on investments that were supposed to make them money are going to be upset. However, there is no way for me to get more information on some of these reviews. Maybe they were bad investments or maybe some people are too quick to complain after a temporary downturn.

2) Misleading Ads - This is something that I would also complain about. Some of the advertisements to get people to subscribe to the different newsletters are down-right ridiculous and can be pretty misleading.

They get a little too carried away at times with their marketing tactics.

3) Overcharges - There are a handful of complaints I've found from people being overcharged and/or charged for a subscription they cancelled, but nothing major--and I'm hoping that these people were able to get things taken care of.

Disclaimer

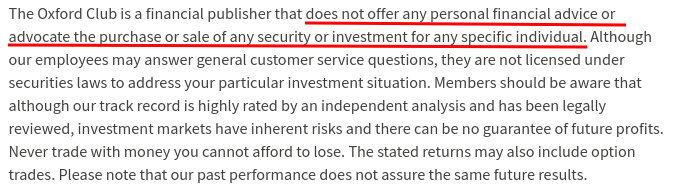

If you ever are suspicious that something might be a scam, or even if you aren't, it's always a good idea to read the disclaimers available for these types of services.

The Oxford Club's disclaimer first states that they do "not offer any personal financial advice or advocate the purchase or sale of any security or investment for any specific individual".

Now you may be wonder... well then what the heck do they do? It seems that providing investment advice is the MAIN THING they do.

Basically what they are saying here is that they don't know anyone's personal situation and because of this their advice is not personal. This is just a way to escape liability for the most part.

Another part of the disclaimer that I think is worth pointing out, and which is a good thing, is the fact that they make their employees wait before investing in recommendations made...

Why is this good? Well, because if they would invest before all of the subscribers they would stand a lot better chance of profiting--since a bunch of subscribers buying a stock recommendation will drive up the price. Without a rule like this they would be able to profit from 'pump and dump' types of games.

One of the concerns about The Oxford Club is that, because many of the recommended stocks are micro-cap stocks, they would be able to do exactly this--buy into stocks and then recommend them to subscribers to ride out the price increase--but this rule described in the disclaimer squashes this concern (assuming that they play by the rule!).

Overall the disclaimer checks out. It may be somewhat unnerving that they state they do "not offer personal financial advice", but if they wouldn't say this then lawsuits would likely be coming at them from everywhere, since not all of their recommendations are winners.

Customer Support

One major problem that I often come across with online subscription services like those offered here is a lack of customer support.

For example, someone will want to cancel a subscription for one reason or another and will have a heck of a time getting in contact with the company.

Luckily, TOC overall is a reputable company and provides a number of ways for customers to easily get in contact with them to work out any issues.

If you need support you can submit a ticket by email via their contact us page or you can get a-hold of them by phone (866-237-0436 or internationally at 443-353-0436).

Pros v Cons

Pros

- Chief editors consist of highly qualified experts with decades of experience in their respective fields

- Potential to make good money based on recommendations

- Low cost for basic newsletter subscriptions

- Good customer support

- The team is restricted from investing in recommended opportunities for a certain amount of time (safeguard against market manipulation)

Cons

- Misleading and over-the-top promotions

- Risk involved (as with any investment opportunity)

- Need additional money to invest

- Many micro-cap stock recommendations (can easily be manipulated--even though there is a rule against this)

- VIP trading services are very expensive

Conclusion - Is The Oxford Club Worth Joining?

The Oxford Club is definitely no scam, but whether or not it is worth joining is a different question.

The good news is that they offer a variety of different services and the newsletters are cheap enough that just about anyone can subscribe (only $49/yr for basic subscription)--the bad news is that there is risk involved and not even the chief analysts make perfect predictions... and you will have to have additional money to invest in the recommendations made.

There is no doubt that some of the marketing material surrounding some of these newsletters and VIP trading services is over-hyped and misleading. I hope this review provided a more clear and informative picture of what exactly The Oxford Club is and what all they have to offer.

If you are looking for a recommendation from me, then I'd suggest Motley Fool's Stock Advisor. This is another investment advisory service. The reason I recommend it is because it is reasonably priced, has a proven track-record, and is run by a reputable company.

Additionally, feel free to check out other resources I have here, such as my list of 70+ ways to make money from home!

Hi Kyle Thank you for doing this review. It does require people to do their homework and invest some money to make money.

Are you doing anything else besides the online affiliate program? It sounds like a nice option for those who are not sure how to earn extra income. I am part of the Talent Acquisition for my company and I can say it is a wonderful opportunity to help ourselves and others to be educated on financial independence. Perhaps you may know someone who may be a fit. I know you are recruiting for your affiliate program but not all people are a fit for all companies or opportunities. I am in a licensed profession so it is much different as I am in the finance arena.

I look forward to talking. Lynda Koch

You’re welcome Lynda.

I appreciate your offer but it’s a little out of my realm. I promote the Affiliate training program called Wealthy Affiliate (which is great if you want to learn affiliate marketing by the way), but I don’t promote any specific affiliate programs.

Very helpful review of The Oxford Club. I think I may order Alexander Green’s Gone Fishing book and evaluate it. Also interested in TOC’s asset allocation recommendations. Trading services seem very expensive. At those prices too much incentive imo for the authors to promote too many ideas.

Thank you. The only thing that really got me from the start of joining oxford was they emailed me back my password over the internet without encrypting or masking it.

This to me is a very bad business practice. Passwords should never be exposed and they could be vulnerable as ble to law suits doing this.

Wow, what a thoughtful, detailed, fair, comprehensive and insightful analysis of TOC! Thank you so much for sharing your analysis with the world. I wonder whether the rating systems is providing an accurate and well-rounded representation of how consumers feel, because I suspect, for example, that the successful investors might prefer to remain quiet, whereas the dissatisfied customers are of course highly motivated to share their disappointments with the world. Naturally, it is difficult to address this question…

Either way, please accept our gratitude for your own hard work and for sharing it.

Best always.

I’m glad you appreciate it Gideon. Thank you for the kind words.

And that is very true. It can be hard to gauge consumer feedback because it seems that people are more inclined to share opinions when they are negative.

Interesting read. I just joined TOC at the $49 level. I am new and a green in this field as they come. And then some. This is the first time I am looking into this kind of thing. TOC has these “Pillar One” advisor/brokers they recommend. I chose Fund Advisors of America in FL. As they say they follow TOC strategies. They are a full service broker.

But then I read you can buy stocks from other places cheaper. Currently my head is spinning. I don’t have much to invest, and if I lose it, I’m done its all I have. Just a former middle class American surviving. Any advice will be helpful.

Hi Robert,

I’m not familiar with the Fund Advisors of America broker, but after a quick look at their website they appear to be a decent option at least. Because they are a full-service broker you probably can find other brokers that are cheaper, you just won’t get “full service”, as in investment advice.

Thanks, Kyle. Very very helpful. I’m about to bite on one if those “early retirement” promos. IfI can find my way back here in a yearI’ll tell you how it went.

Always happy to help Shelden!

Well I hope all goes well and will be looking forward to hearing back from you.

This is an excellent review of the Oxford Club and their offerings. You did a better job differentiating their services than they do on their own website, although I think that might not be accidental. I have subscribed to many newsletters over the years as I’ve been investing for about 35 years, and I must say I do like their Income Strategist Marc Lichtenfeld. He is down to earth, realistic and translates his advice well to the average investor. It’s odd that he’s with some of the other clowns at TOC. Most of the other services report ridiculous returns that remind me of carnival pitchmen hawking dime tickets to see the hairy baby from Borneo. They report their wins, but losses are never reported. The suite of services is not an outright scam, but it’s a collection of overpriced, mediocre to poor performing newsletters. I would personally recommend Marc Lichtenfeld’s income and Steve McDonald’s bond letters. Other than those 2, you’re purely gambling.

Hi Joe,

I’m glad you liked the review and really appreciate your comment. I have heard similar good things about Steve McDonald’s Oxford Bond Advantage. Glad to know you are fairing well with their recommendations.

What are your thoughts on Bill O’Riley’s role?

No sure, but could be just a paid endorsement. It’s hard to say for sure.

I’ve always wondered whether The Oxford Club is legitimate. Because there are so many roads that lead to The Oxford Club, it seems they have found a dozen ways to get into your pocket, and their claims for instant success are so way overblown. Your comprehensive overview and I would say balanced analysis is much appreciated. I’ve decided to try out Automatic Fortunes because Ian King is a graduate of Lafayette College (my daughter’s alma mater), and so can’t be all bad. How’s that for reasonable decision-making? Cheers.

Bill Fullarton

Hi Bill,

That is true. There are a lot of different teasers floating around out there that lure in subscribers from different angles… and pretty much all are misleading and overblown as you said. It’s the marketing material that is the scammy part about them. The company is legit and does provide real value though.

Hopefully your portfolio fares well with Automatic Fortunes.

I joined the Oxford Club in 1994. I became a Director’s Circle member less than a year later, and just recently became a Chairman’s Circle member. Kyle, your review is excellent. You accurately pointed out that the recommendations had some wins and losses. I’ve seen a lot of both with the club. What I think goes wrong with the subscribers who get clobbered is that they didn’t read and follow the Club Pillars of Wealth. I could be wrong, but that page should be read again and again, almost memorized, before you invest one dime in any recommendation. I know the publishers would back me on that. The philosophy is key. Never invest more than you can afford to lose.

Thank you Chuck for the comment and I’m glad you liked my review. I agree… and I bet a fair number of people don’t follow this core guideline to investing.

I have been very pleased with The Oxford Club. However, don’t get sucked into joining Trailblazer Pro for $2,000. They do not live up to their hype. They tell you they will recommend stocks at the optimum time to buy and also the optimum time to sell. They don’t do either regularly. They are especially bad about telling you when to sell. It just isn’t worth the price they are charging.

The Oxford Club is still at it, giving stock tips at $2000 a pop. They claim that their tip is a time sensitive investment that will expire in two days, but when I didn’t bite, a week later they came back with the same message and then a third time with the same message a week or two weeks later.

A year later they will come back again with a similar story with minor modifications of the same stock.

The article below explains the relationship the Oxford Club and the Wealthy Retirement and the Health Science Institute Inc.

This is what is behind that fake doctor claiming that he has the cure for cancer and that 9 common drugs causes Alzheimers’s like symptoms!

Read the connection between these groups:

https://www.motherjones.com/politics/2015/12/agora-huckabee-conservative-bible-cures/

POLITICS

NOVEMBER/DECEMBER 2015 ISSUE

How This Company—and Mike Huckabee—Cashed In by Scaring Conservatives

A little-known publisher has built an empire on selling Bible cures and apocalyptic stock tips.

Hi Diana. Thank you for sharing your research. These companies are owned by the larger company called The Agora. It owns most of these newsletter publishers. You can read a review of The Agora here that I wrote.

The Club has done well for me. Quite well, actually. I did lose some money with a Chinese stock, but that’s my own fault; I didn’t have a trailing stop in place and then C-19 hit. Had I followed the trailing stop advice, I would have still lost, but not nearly as much.

But again, overall returns have been great and I’m definitely learning a lot. It’s exciting for sure.

PS-When you read any promo that has a countdown timer with “limited memberships” available and “act now” triggers, it makes you wonder about the legitimacy of the claims. You think, “yeah, right, you’ll take my membership anytime.” Well, I tried to join the War Room after the promo and they won’t let me in. Put me on a wait list. Go figure.

Thanks for the comment David. Good to hear from an insider.

Regarding the comment left by the individual who had a $14.00 stock drop in value to $4.00 and then $3.00, they must not have been following one of the key factors given to all of The Oxford Club’s investment recomendations. All recomendations come with a 25% trailing stop (no exceptions), which would increase with the stock if the value was to increase. With a $14.00 stock investment, this recomendation would have came with a recomendation to sell off the stock at $11.50. The investor either opted to let the investment ride as it plummeted against the core advice of The Oxford Club or didn’t have a systme in place to notify him or his broker as the stock reach his trailing stop amount. Every single stock The Oxford Club has recomended since the Covid-19 Pandemic has hit is up over the past 3 month period or it has been recomended to sell with a profit. They also offer a tool that allows you to adjust your potfolio accoring to your income goals and willingness for higher risk. Their customer service is on point and they look at everything on a case by case personalized basis. They really value loyal subscibers and will offer limited oppurtunities to members that are very worthwhile. As David mentions in the previous comments, promotion time limits are kept which adds validity to their limited enrollment programs. I have been attempting to find something half as good as this for ten plue years to no avial. For those interested in getting the most out of this service I would recomend signing up for one or two services for two years (costing around $3000 – $6000 at the discounted prices for promos/multiyears). Within this time there is a potential you will get an offer to join The Director’s Circle or (in very rare occurences) The Chairman’s Circle (only ever done twice. They offer these oppurtunities on a very limited basis so you would want to act right away (usually from 100 to 300 positions per promotion). Normal membership for The Director’s Circle is between $40000 – $50000 for a lifetime membership (which is the appoximate cost for a single year of membership to all of The Oxford Club’s services); but promotional offers are sometimes given (up to 75% off one year membership). The Chairman’s Circle is usually only offered to longterm members or as an upgrade to The Director’s Circle members (an has only been offered twice in the organization’s history to regular members; maybe to expand the number of this group or to create an immidiate influx of income for The Oxford Club). An amazing feature of The Chairman’s Club is that it can be bequethed to a loved one or shared with a loved one/ partner/ business partner. So the service becomes indefinate. If I had the means, I would invest in this service at the highest level for all of my loved ones and would recomend it to those that want clear direction from investors with amazing track record. I was very suprised at the overall legitamacy of this organization as many of their mailer adds and promotions are long winded and seem too good to be true.

Love your thorough and accurate review. I enrolled in the Communique in March and of course that was the time that everything went down fast. However, following the wealth pyramid advice made a lot of sense and I have been doing well. I have the Dynamic Fortunes services from Matt and for me that has been the best one of all. Some loses as well as amazing gains. I believe the overall is positive although I got to admit that I get anxious and llevar the positions early when I see the gains.

Hi Roberto. I’m glad to hear you have been doing well with the services, even through the crisis.

Thank you for your comment.

SOUNDS GOOD

Excellent Summary and research! I had done some research on Stansberry a few years ago. The best advice perhaps is “Caveat Emptor”… Buyer beware!

i ordered the oxford club newsletter package for $49 after i said submit order it informed me that i would be billed $444. looks to be a scam. i m trying to cancel

I Paid $2500.00 to get the Oxford Communique. Was sold on it being a crypto-currency newsletter. Does’t sound like too many people were as stupid as I was, considering the article says the Oxford Communique is Way Way less. I should probably have spent the money on a good financial advisor. Are there any of those left in todays world of “make money at all costs and let the buyer beware”?

Yes, I,m a member of TOC, I,m presently subscribe to the Oxford Communique and the Strategic Trends Investor. The Oxford Communique Pillars of Wealth concept I believe is a very good concept to have affixed into you mind at all times. Speculative Stocks (Stocks with no EPS data, or positive earnings) should always have a 25% Trailing Stop Loss attached to it’s most recent 52 wk high. Sell it if drops 25%. Other Stocks, do your homework. If the Stock drops 25% you’re best to analyze it, and if in the words of Jim Cramer, you come to the conclusion you have a broken stock, not a broken Company. You might consider doubling down on Your investment with the company. Your Homework should show that the Company is fundamentally sound and should have upcoming positive earnings going forward. Read and analyze it’s most recent quarterly reports. Read as much as possible on the company’s economic sector and its competitors. Homework, Homework, Homework.

Thank you for your independent analysis of TOC. Thank you for reminding people theirs more than one source of investment paths of financial advice out in this world. I’m Ok with TOC, they’re basically sound, thou I’d recommend people not to spend more than they can afford for financial advice, and not to get continuously led down the road to spending for a never ending slew of hocked investment newsletters.

Be aware and stay away! That is a simple warning about the so called OVI trading system. Anyone who signed up will hear the same comments every week. No commitment to any stock but a list longer than your forearm on stocks you should monitor.

During each weekly session you will see stocks that are “setting up and has the OVI indicator confirmation” to go long or short. The simple fact is that the loosing trades outweighs any and all winners. After a few weeks you will then be dubbed into the “Elite money traders” this will maximize your profits and send you to the stratosphere!

All a load of rubbish! As a novice I made 100% of the capital that I started with. After the OVI and Elite money scammers I lost all my profit and then some. What a load of complete and utter bollocks! Not to mention the endless amount of emails that you will be bombarded with. Have a look into the connection with DTI and the endless amount of gurus that will all try and sell you the next genie in the bottle.

Your email will be flooded with other “investment gurus” who also claim they have the golden algorithm. No idea how they get your email?

Have a look at DTI; they are all connected. Everyone of these “gurus” will start as low as $3 for the first month and before you know it the “proprietary tool” will be $1495!

No one seems to be willing to commit to any trade they recommend for you but somehow they will make a profit while your account shows a loss. I am still trying to figure out the math on this.

End of the day it’s your money and your time