Can you really add your name to some list to collect "Mortgage Reimbursement Checks" for thousands of dollars?

Or are "Mortgage Reimbursement Checks" a scam that it's best to avoid?

One thing is for certain... they are NOT what you are led to believe they are and they are NOT so miraculous.

In this review I'll be breaking down what exactly these checks are, the opportunity being presented, what you are being pushed to buy into, and more.

You are going to want to read this!

Overview of "Mortgage Reimbursement Checks"

"Mortgage Reimbursement Checks" is a name coined by D.R. Barton for checks that you could potentially receive after making certain investments. There aren't actually checks that are called this--the name was just made-up for marketing purposes.

The promotion, as I will go over next, is extremely misleading and is actually a lure to get people to subscribe to his paid newsletter service called 10-Minute Millionaire Insider.

This may sound really confusing at first because it is not what you are led to believe, but I'll explain everything you need to know... including what these "Mortgage Reimbursement Checks" really are.

Let's first go over the teaser and some of the lies told...

The Teaser

There is a good chance that you have come across the teaser that starts out with the headline that "Through a little-known U.S. government initiative. Americans can now collect... "Mortgage Reimbursement Checks""...

And I'm guessing that the opportunity sounded a bit shady to you, which is why you are reading my review now.

And it's a good thing you are, as you will see.

In a nutshell, we are told that there is a $72 billion money pool that is about to be distributed across America by two federal mortgage giants and that you can get your hands on a chunk of this money pie.

As the story goes, back during the 2008 housing crisis the government used $191 billion of our tax dollars which they are now trying to give back.

The solution to get the money back to the people was inside U.S. Public Law 99-514, which is what supposedly opened up this $72 billion opportunity.

However, this law was said to have been "almost forgotten about" until it was used for these "Mortgage Reimbursement Checks".

Fake Checks and Fake Pictures

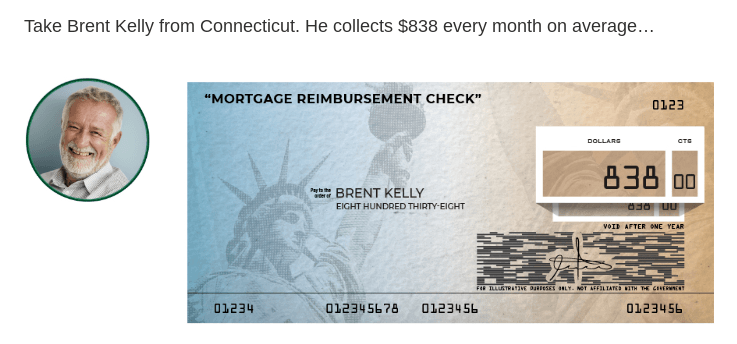

In the teaser we are shown a bunch of checks that people have supposedly collected recently, such as that shown below for $838...

However, these images of the checks are completely fake, because as I mentioned and as I will explain in a bit, "Mortgage Reimbursement Checks" don't actually exist. The name is made-up.

Not only are the images of the checks fake, but the people shown are also fake.

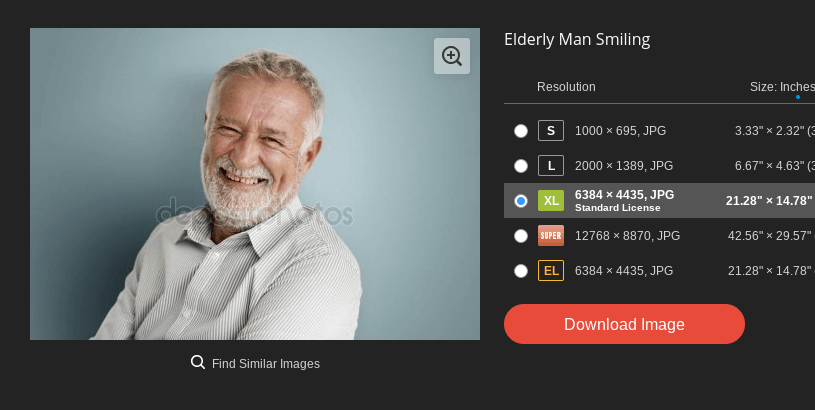

The man shown above is said to be "Brent Kelly", but I highly doubt that since the image of him is actually a stock photo that I was able to find on the website Deposit Photos...

This is a picture that the creators of this promotion simply bought online.

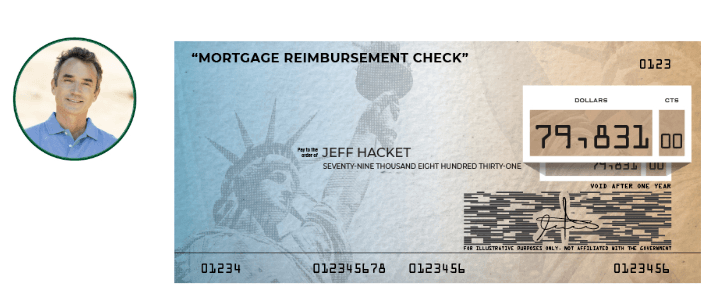

And it doesn't end there. There are plenty of these fake checks shown... some up to as much as $79,831 collected by guys like "Jeff"...

After doing an image search on Google for the picture shown above I was able to find it on multiple other websites... which means it is another stock photo more than likely...

*Note: Some checks that were shown were for close to $300,000!... but fake of course!

Ridiculously Misleading

No, you don't simply add your name to some "distribution list" like you are told.

The opportunity is much different than it probably seems, due to the fact that it is promoted in incredibly deceptive fashion.

Overall the teaser is absurd... but I'm pretty used to it at this point. I've also reviewed other teasers, like that of "American Superpower Checks" which were the same basic thing.

What Are "Mortgage Reimbursement Checks" Really?

Although the teaser is quite misleading, there is a lot of truth to it... it is just hard to decipher from the hype.

The truth is that back during the 2008 financial crisis the two behemoth mortgage providers, Fannie Mae and Freddie Mac, were bailed out with taxpayer money.

Apparently there had been attempts made to get these companies to pay back what they took, but until now they have failed. The Federal Housing Finance Agency (FHFA) was then able to find a "loophole" under Title VI of U.S. Public Law 99-514 where, to make it plain and simple, they have to pay back money to the people. Of course it's more complicated than that, but this is the gist of it.

However, since returning to profitability they have already paid $115 billion more in dividends to the Treasury than they received in the 2008 bailout, which is the reason they are fighting back in court to keep their profits. So this situation is far from being a done deal and there is a lot of uncertainty as to how it will play out at this point.

That said, there is a large chunk of money, $72 billion as mentioned, in a pool that people can get a piece of... but it will require investment.

"Mortgage Reimbursement Checks" are really just dividend payments

Yes, this is all they really are. You won't be simply adding your name to some list to get these checks. This is an investment opportunity that is being teased here and you will have to invest capital upfront... the more you invest the higher dividends you will receive.

What you have to do here is join privately held trusts that receive money from this whole deal, and these trusts are obligated to pay 90%+ of the profits to shareholders.

So in a nutshell this is what is going on:

- Fannie Mae and Freddie Mac got large government bailouts back during the 2008 financial crisis

- They are now paying back billions of dollars

- You can buy shares in privately held trusts to get your hands on some of this money

- So indirectly you are getting paid back from the mortgage giants Fannie Mae and Freddie Mac, which is why these checks are being called "Mortgage Reimbursement Checks".

Who Is D.R. Barton Jr?

DR Barton Jr is the man behind this whole thing. He is the man who came up with the term "Mortgage Reimbursement Checks" and he is the one all over the internet talking about them.

But who is he really?

Well, he used to work as a chemical engineer at DuPont but has since become a professional trader, now with over 30 years of experience.

His main focus at the moment seems to be his 10 Minute Millionaire subscription newsletter service where you gives subscribers investment advice on a regular basis so that they can follow along with professional recommendations.

Besides that he is also a co-author of Safe Strategies for Financial Freedom, a best-selling book, and he is often featured on Fox Business, CNBC and other media outlets as en expert analyst.

He definitely seems to have quite the experience and might be worth listening to, however you should know that he has made ridiculous promotions similar to "Mortgage Reimbursement Checks" in the past--one that comes to mind being something he called "Federal Rent Checks"... and basically all of these promotions are just ways to lure in new subscribers to his newsletter.

*His newsletter that you are forced to purchase to find out more about the "Mortgage Reimbursement Checks" opportunity.

The Newsletter You Have to Purchase

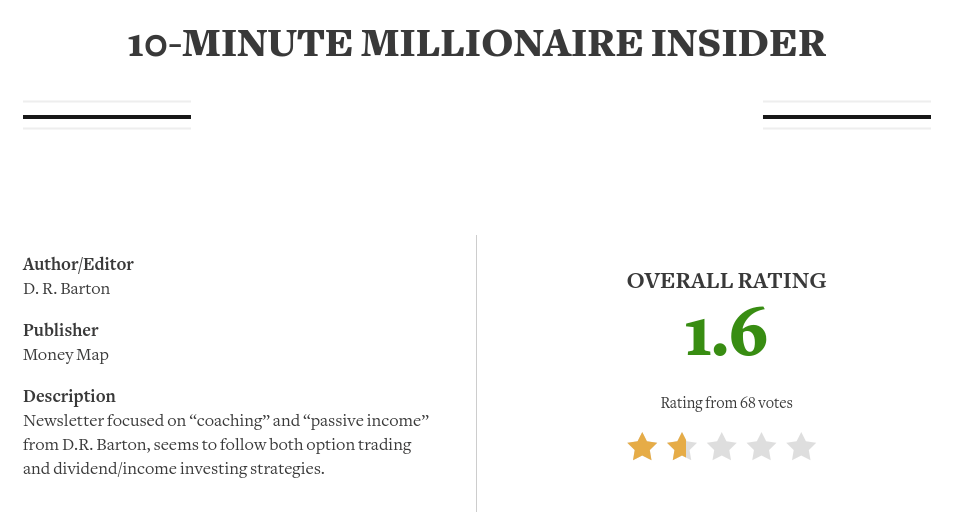

10 Minute Millionaire Insider is the newsletter that DR Barton runs, which is published by Money Map Press.

You will be pushed to buy into this newsletter if you want the "free" report on the "Mortgage Reimbursement Checks". The report is said to be free, but you first have to subscribe to his newsletter... tricky isn't it?

I'm not going to get to into detail about the newsletter here, but I'll give an overview.

The 10 Minute Millionaire Insider is a subscription newsletter similar to Alpha Investor Report and Weekly Money Multiplier where DR Barton provides subscribers with:

- A monthly newsletter where he goes over the performance of past recommendations and provides details on new investment opportunities he is looking at

- Weekly podcast recordings where he talks about new opportunities, trading strategies, what the market is doing and what you need to be aware of, etc.

- Live video chat sessions where you can ask him questions and get expert advice

- And more...

This type of investment advice service is usually best for people who have little to no experience or knowledge and want some guidance to lessen the risk of investing... or just for anyone who wants to follow advice from someone who has 30+ years of experience and is knowledgeable enough to be featured on news channels as an analyst.

Price

The cost to join his subscription service is $39/yr for the Base Package or $79/yr for the VIP Package, which is the better deal because it includes bonus reports and a 2-year membership rather than just 1-year.

Both come with a 60 day money-back guarantee, but getting a refund from this company seems to be pretty difficult. On the review site HighYa Money Map Press has a 1.4 out of 5 star rating and many people are complaining about refund difficulty.

Rating

As just mentioned, the average rating on HighYa is 1.4 out of 5 stars, which is poor.

When looking around on other sites I found that the newsletter itself has a low 1.6 out of 5 star rating on StockGumshoe...

*The rating for investment performance of this newsletter is a 1 out of 5 stars on StockGumshoe

There are some good reviews, but overall negative... likely because of how misleading the teasers are--which pretty much guarantee disappointment after buying in.

Scam or Not?

So are "Mortgage Reimbursement Checks" a scam?

I said it in the beginning and I'll repeat... I don't consider this whole thing a scam, HOWEVER, I'm willing to bet that a lot of people feel scammed after being pushed to subscribe to the newsletter and then finding out the truth of what is going on.

Not a scam in my opinion, but there are a lot of shady marketing tactics going on here and I'm not a fan.

Conclusion

Okay, let's do a quick recap to sum this all up in as little words as possible.

- "Mortgage Reimbursement Checks" don't actually exist

- You can indirectly get paid from the money Fannie Mae and Freddie Mac are paying back

- The checks you can collect are dividend payments, meaning you will need money to invest

- In order to get all the details on how to invest in this opportunity (the "free" report) you have to first subscribe to DR Barton's 10 Minute Millionaire Insider subscription service

It's tricky and things aren't what they seem at first.

I hope this review has given you a much clearer picture as to what this opportunity is and what is actually going on here.

Please leave any comments and/or questions below and I'll get back to you as soon as I can 🙂

PS: It has nothing to do with investing, but if you are looking to make passive income then I highly recommend this program that I use--and have been using since 2015.

I think you might be interested since you were looking into this whole "Mortgage Reimbursement Checks" thing. Check it out.