Is Jeff Clark's "3-Stock Retirement Blueprint" a scam? Is it just another misleading investment promotion that is going to end in disappointment?

You've probably come across the teaser, which has the title of "The 3-Stock Retirement Blueprint: How to Retire Rich Using Just 3 Stocks"...

And I'm guessing the whole thing just sounded a little bit too good to be true to you... which is what led you to do some extra research and land on my review here (and it's a good thing you did!).

In the teaser Jeff tells us that there are 3 stocks you can play to retire richer than if you were to trade all the rest...

And of course he is going to tell us the 3 stocks he is talking about, or so he leads us to believe.

The claim is that he uses some strategy he developed to generate tens of thousands of dollars a year... which he proudly boasts allows him, if he would want to, to take a 2-week family trip to Italy, take a boat and charter down the California coast, and do other things with all the freedom he has from trading these 3 stocks.

And the opportunity is really hyped up, with claims that in "less than 24 hours" you could double your money...

In the teaser we are then show a bunch of success stories from people who have supposedly been making good money following Jeff's strategy, such as Chuck Reddick who made a "quick and easy $1,100"...

.. and "Grant Reynolds" who supposedly made $310k in just 9 months...

HOWEVER, who knows how much of this information is real or fake.

Later in the video presentation my suspicions grew.

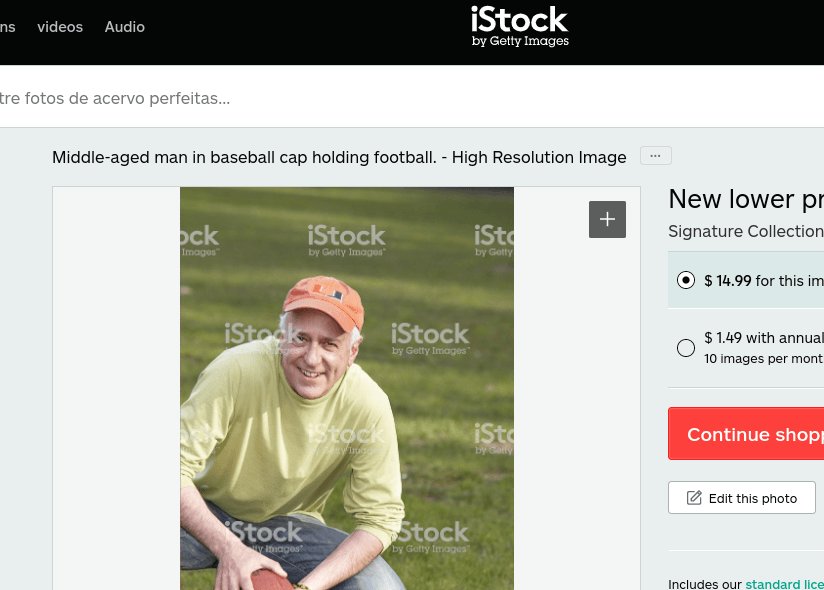

I decided to do a reverse Google image search for the one picture of "Paul Reeves" who has supposedly be earning a nice $1k/mo...

... and I found that this is actually a stock photo that anyone can purchase online.

So if this is fake then what else is fake?

I've reviewed plenty of investment opportunities in the past as well that have been filled with lies in their promotional teasers, such as The Perfect Retirement Business & Marijuana Payouts for example.

The bottom line is that the teaser for this "3-Stock Retirement Blueprint" is incredibly misleading and leads one to believe that it's a sure-fire way to strike it rich, which is far from the truth.

In this quick review I'll be going over what is really going on here and what you should know!

What Is the "3-Stock Retirement Blueprint"?

The "3-Stock Retirement Blueprint" is a teaser for Jeff Clark's Jeff Clark Trader advisory service.

It's all part of a sales funnel to lure people into this $199/yr subscription service, which is a follow-along style advisory service that tells members what to invest in and when to invest, as well as information to keep them up-to-date with what's going on in the markets, similar to many others like Utility Forecaster and Options for Income.

When you subscribe to the service you are provided with his 3-Stock Retirement Blueprint right away, which will tell you what 3 stocks he recommends and will provide information on why. Additionally you will get:

- Monthly trade recommendations - Each month Jeff makes a new trade recommendation.

- Updates - Subscribers are updated when need-be, such as when it's time to sell.

- Video training series - This includes a series of training videos on options trading, which is great if you are new to it all.

This is the core of the membership.

Jeff Clark Trader is all about options trading, which I'm sure you are well aware of if you saw the teaser.

Jeff talks all about how options trading can make you more money faster and conveniently leaves out the part about this form of trading being much more risky.

Options trading can be very lucrative, but this comes with increased risk.

For a brief overview of what exactly options trading is, you can watch this video I found that explains things well:

Who Is Jeff Clark?

Jeff Clark [Source: jeffclarktrader.com]

After listening to the teaser you may think that he is just some average Joe that talks too much, but Jeff actually has quite an extensive background in the world of investing... nearly 50 years of experience!

Currently Jeff Clark edits several investment advisories, Jeff Clark Trader just being one of them. He's been in this line of work for over 15 years now.

Before this he ran a private money management firm and brokerage house, in which clients trusted him with tens of millions of dollars.

He also has a good educational background, with a MBA (not that this matters too much).

So, although Jeff throws one heck of an overly-salesy sales pitch, based on his background he seems like the type of guy that you'd want to provide investment advice to you.

That said, there is a lack of transparency with his advisory service (of course) and I'm not sure how good its performance is overall.

What 3 Stocks Does He Recommend?

The 3 recommended stocks by Jeff are constantly changing. With his strategy he recommends 3 stocks at a time and trades them until he feels they have run their course. This way, he keeps changing things up.

However, as an example, some of his recent picks were:

He calls these "fast money stocks", and although they all have large caps, trading options on stocks like these can still potentially bring in fast gains.

*Please inform me via the comment section below if the recommended stocks change. This will provide great value to other readers.

Cost & Refunds

I've mentioned that the subscription price for Jeff Clark Trader is $199/yr, however there is a special offer going on as I am writing this and it is discounted to only $19.

Refunds

The price isn't too bad, but unfortunately they do not offer refunds, instead providing credit to purchase another one of their services, which is something most people probably wouldn't be interested in if they are trying to cancel.

This is what they call a "90-day legacy credit guarantee". You have 90 days to cancel your membership for credit.

But what's the point?

Pros v Cons

Pros

- Easy to follow service

- No experience needed (although I certainly don't recommend blindly following recommendations)

- Advice provided by professional trader

- Low barrier of entry - options trading doesn't require as much initial investment

Cons

- Misleading promotions make it seem like a guaranteed way to make money

- Options trading is more risky than stock trading

- No refunds

Is It Legit?

Yes, this whole thing is legit, although very misleading.

The fact of the matter is that the service being promoted here, Jeff Clark Trader, is a legitimate advisory service.

That said, I can absolutely understand how some people would feel scammed after being lured into a subscription through such an over-hyped and misleading teaser.

Conclusion - Avoid?

I can't provide any clear answer to this. It is something you will have to answer for yourself and depends on what you are looking for.

It's also a bit hard to recommend something when there is no record provided of past performance.

If you want an advisory service with a proven and transparent track record, and that doesn't mislead people to subscribe to their services, then I'd highly recommend Motley Fool's Stock Advisor service.

But anyways, I hope this quick review has helped clear some things up for you. Please share this post to help spread the word, and to help out my site 🙂

What are your thoughts on the 3-Stock Retirement Blueprint? Leave them below in the comment section...

Thanks for your honest review Kyle it was helpful. The 3 stock blueprint caught my eye

as I sell options on the S&P E-mini index with a decent return although I get burned occasionally when I get greedy. My view of options is you are betting on the side of an unlikely outcome. Just like insurance companies bet that your house is unlikely to burn to the ground and collect handsome premiums for taking that bet.

The trick is to pick a stock or index that has enough volatility for decent premiums & behaves in a fairly predictable way most of the time.

I love this game especially when I’m winning of course! ( :

Cheers – James Ross

Hi James,

I’m glad you appreciate the review. Also, thanks for the feedback. I’m sure it will help out other readers!

I just read the review of your system and only have to say SHAME ON YOU. You guys are all the same with your its easy, blah blah blah make thousands in seconds. Jesus, if it was not so pathetic it would be laughable.

I have to wonder why are you selling your picks if you are making so much money. Is it because you are ultra generous? Hell no your are a capitalist which goes totally against being generous. I suggest you are selling your picks as a way to cover your losses otherwise why go through the hassle of running a business with all its headaches if you could JUST SIT AND HOME AND CASH IN ON ALL THESE WINNERS.

Options are dangerous way to lose money quickly. Maybe that should be written someplace pal.

Hi James. I’m just a someone reviewing their product, not the company behind it. That said, I understand your frustration with these types of investment services.