Money Map Report is a newsletter that can supposedly help you invest like a pro and make a bunch of money... well at least that is what they lead us to believe.

Can you really trust this newsletter and the advice given? Is Money Map Report a scam you would be better off avoiding like the plague? Will the recommendations just lead to a less valuable portfolio or will they help you grow your nest-egg into a small fortune?

With all the over-hyped marketing material it's hard to know what to believe, which is the reason for this review. In this review I'll be going over what exactly Money Map Report is, what you get as a subscriber, misleading marketing claims, complaints, pros v cons and more.

Enjoy...

What Is Money Map Report?

- Name: Money Map Report

- Product Type: Investment newsletter

- Publisher: Map Money Press

- Chief Editor: Keith Fitz-Gerald

- Price: $299/yr

- Recommended?: For some

Overview

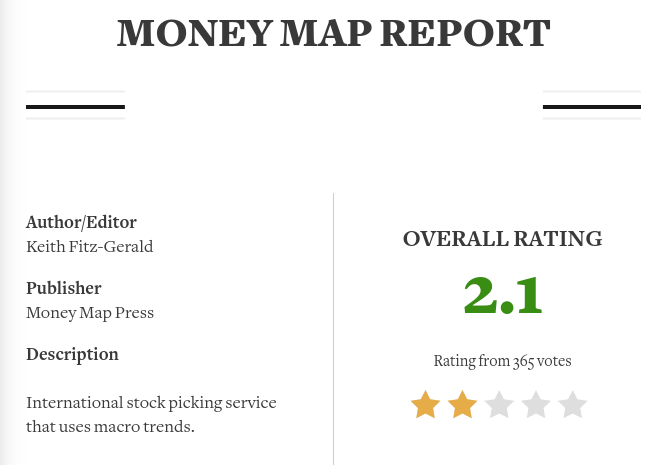

Money Map Report is a financially newsletter published by Money Map Press with the chief editor being Keith Fitz-Gerald.

It is one of their flagship newsletters and is focused on a wide range of global investment opportunities, in which Keith and his team recommend based on trends in the market.

With Money Map Report you can follow along with Keith's recommendations and the idea is that you can invest like a pro... without actually being a pro.

It is possible to follow along without any experience or knowledge, but of course having some helps... because you never just want to blindly invest based on the advice of someone.

Company Background

Money Map Report is published by the company Money Map Press, which publishes a number of different financial newsletters and trading services, including Nova-X Report (which I recently reviewed).

Money Map Press is led by Mike Ward and has a number of investment experts working for them, Keith Fitz-Gerald being one of them. They are actually a part of a larger company called The Agora, which owns Agora Financial, The Oxford Club, Banyan Hill Publishing and others--they own pretty much all the financial newsletters you hear about.

The company is based in Baltimore, MD and is legitimate, although you will find a number of complaints questioning such (which I'll talk about).

The Teaser

There have been lots of teasers to funnel people into subscribing to the Money Map Report and there will continue to be more, but I'll go over the current teaser because they are all laid out in the same way.

Right now the teaser is that the Social Security owes people money and "if you're one of them, you could get a lump sum check within 5 days..."

In this teaser we are told that there have been "extraordinary errors" found in the processing of Social Security checks in recent audits... and supposedly most victims of this mistake will be able to collect checks of up to $23,441...

We are told that there is around $25 billion in unpaid benefits just waiting for people to "claim" it.

But of course this all sounds too good to be true and it leaves you wondering... why would a company that makes money selling investment newsletters be talking about 'claiming' unpaid social security?

Well... as you can probably imagine... teasers like this are incredibly misleading.

I'm not going to get into all of the details, but how this all works is you are offered a "free report", like this one titled "How to Claim Your $23,441"...

... but in order to receive this "free" report you first have to subscribe to the Money Map Report Newsletter.

These are the types of teasers you usually find for newsletters like this. They lure people into subscribing from multiple angles and are often way over-the-top and somewhat deceptive in the way they do so... often being filled with exaggerations, misleading information, and all-around just sound way too good to be true. They are usually the type of marketing that we don't really care for... the deceptive type.

What You Get

Monthly Newsletters - This is obviously the core of what you get.

Keith and his team analyze the market looking for good opportunities and each month you will be sent a very detailed newsletter that provides at least one investment recommendation, sometimes more depending on the market.

These provide a lot of information and analysis as to why the recommendations are being made... so it's not like you are just told to blindly invest in something and that's it.

Keith will go into detail about what he recommends and why he recommends it, including his thought process behind it all.

Weekly Email Updates - The weekly updates are focused on where the market is going and how that might have an effect on current positions in the model portfolio, which consists of all Keith's recommendations.

He will keep you up-to-date on what he thinks is going on, what matters and what doesn't matter, key news, events that might have an impact, and so on.

Urgent Alerts - You might get these notifications at any time--which are alerts that tell you if you need to exit a position.

You will likely want to act on these fast, although it depends on the situation.

LSV Index - I'm not all that familiar with this, but apparently it is an indicator that helps simplify the opportunities in the market and lets you know when there are good buying opportunities.

Access to the Intelligence Network - This is where you can interact with other subscribers online. You will be able to share trade strategies and so on.

Audio/Video Briefings - These consist of recordings that can contain any relevant information. They may be more along the lines of a market update, something about a new recommendation, etc. Anything is fair game.

Tactics & Risk Management Tutorials - Two times a week you will be provided with tutorials to help you stay safe and avoid risk in the market.

Members Area Access - You will get access to the members only website where you will be able to find everything discussed here. All of the newsletters, alerts, etc will be here in case you missed something.

Concierge Service - This is the fancy term they use to refer to their customer support team that is there to help you out with subscription related problems. This service does not provide investment advice or help.

Focus Areas

The focus of this newsletter is very broad. Keith and his team look to identify international macro trends in the following areas...

- Demographics

- Scarcity

- Medicine

- Energy

- Technology

- War/Conflict

With a wide field of view like this much of the market is in their radar.

Who Is Kieth Fitz-Gerald?

It's always important to look into the people behind investment newsletters like this.

Is Keith really qualified to be giving recommendations? Can you trust what he tells you?

Well, although the man does over-hype the heck out of his newsletters which may make him seem somewhat untrustworthy... he does know what he is talking about and has plenty of experience under his belt.

He has close to 40 years of experience and is a former professional trader and licensed CTA. Keith has been featured on media like Fox Business, CNBC Asia, Bloomberg and more for his market analysis... and has also been mentioned in Forbes, MarketWatch, etc.

Money Map Report is his most popular newsletter but he also runs High Velocity Profits and Straight Line Profits, which are newsletters more focused in specific areas of investment.

Some of his biggest claims to fame include how he was able to (somewhat) predict the .com crash and the 2008 financial crisis, in which he helped investors navigate through them without losing as much money as they might have without his help.

Overall this guy is someone who is well qualified to provide the advice he does... you just can't get too caught up in the ridiculous teasers he throws at you, which always sound much better than they really are.

Track Record

So what's the track record of this newsletter?

Have Keith's recommendations been making subscribers boatloads of money or have many of them turned out to be duds?

Well, unfortunately the company isn't transparent with this information. Sure, they often make it well known in their sales pitches and such when there have been big winners, but as for all of the losing recommendations, well, there isn't information on these.

I don't like to assume too much, but because of this lack of transparency I am forced to suspect that they have something to hide... meaning a past track record they would rather not show us.

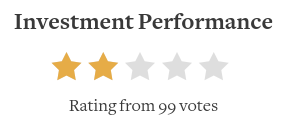

The best piece of information I have on this comes from the 'Investment Performance' rating on StockGumshoe. This is a rating given by subscribers and as of this review there are around 100 independent votes with an average rating of about 2 out of 5 stars... not that great...

That said, it's also worth mentioning that there are some subscribers that have been more than happy with the performance of the recommendations made and have profited nicely from them.

While the overall rating is pretty bad and the lack of transparency leads me to assume the worst... it might not be quite as bad as it seems.

Cost

The cost to subscribe for a year is $299. This is a fairly steep price... but I suppose it could be well worth it if your investments make returns larger than this amount.

One thing to take note of is that you will be billed automatically the following year if you do not cancel. This is something I've seen some complaints about from people who were unaware of this.

Refunds

There is a 30-day money-back guarantee. There isn't much information provided on this, but I'd assume that you should be able to get a refund no questions asked... although as I'll go over next in the complaints section, this might be easier said than done.

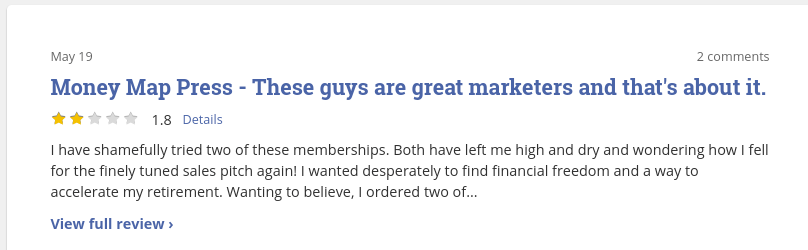

Subscriber Reviews/Complaints

One of the best sources of subscriber reviews that I have come across is StockGumshoe.

Right now Money Map Report has an overall average rating of 2.1 out of 5 stars with over 350 votes total.

This obviously isn't that great of a rating. But why is this?

Well, some of the more common complaints I have noticed include the following:

Deceptive Marketing - As we already know, Money Map Report is often promoted in misleading and deceptive ways... such as how right now you can supposedly claim an average of over $23k from unpaid social security.

Why do they feel the need to lure in new subscribers with this sort of trickery? I have no idea, but I don't like it and neither do subscribers...

And then this review below I found on PissedConsumer... but it's more of a general review for the company as a whole and not specifically this newsletter.

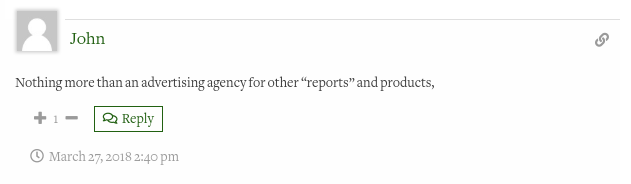

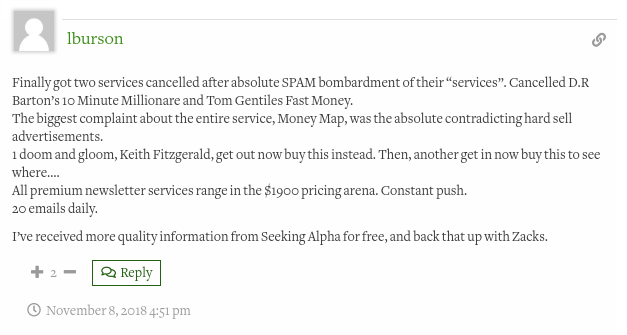

Promotional Bombardment - Another common complaint is from all of the spam you get as a subscriber.

Unfortunately Money Map Press, the company behind this newsletter, will not be satisfied if you are only subscribed to Money Map Report and they will bombard you with promotions for their other newsletter services.

No one likes this kind of activity... and that is why there are so many complaints like this about it...

Lack of Transparency - I guess this could fall into the category of deceptive marketing, but what I'm talking about here is how they do not disclose the track record of past recommendations made. If they would do this it would be great and would really give people a good look at what they are getting involved with... but unfortunately they do not do this.

The big winning recommendations that Keith gives out are often talked about endlessly, but the losers are conveniently forgotten.

Apparently even if you request more information on the track record they don't provide you with such...

Might Be Difficult to Get Refund - There have been a few complaints from people having difficulty getting refunds... but I don't have any details on these particular situations so I can't speak too much on them.

*For a more detailed look at some of the top complaints against this company you can read this post.

Concerns

One concern that I want to address comes from the Terms & Conditions page at Money Map Press.

As you can see below, they state that they do "not act as an investment advisor or advocate the purchase or sale of any security or investment"...

So then you may be wondering... well what the heck do they do? It seems that this is ALL that they do.

Well, basically what they are doing here is covering their butts for legal purposes. And while it may seem a bit suspicious, it is absolutely necessary with all the lawsuits being thrown around nowadays.

Yes, they definitely DO advocate certain investments... I think we can all agree on this. But, they have to say that they don't.

Market Manipulation

Another concern is that of market manipulation.

The concern is that the people making the recommendations could be doing such for their own financial gain... such as buying a stock and then recommending it, hopefully getting the price to increase from everyone buying in and then selling.

This is also addressed in the same paragraph from the T&C's page shown above. Here you can see that they forbid their writers from having a financial interest in their recommendations and that they require employees to wait at least 24 hours after publication before following a recommendation...

While these rules may be nearly impossible for them to enforce, it's still nice to see that they are trying to safeguard against this kind of thing.

Pros v Cons

Pros

- Nice layout and breakdown of reports (monthly newsletter, weekly updates, etc)

- No experience or knowledge necessary to follow along (you can trade like a professional without having any experience) (I definitely don't recommend following blindly however!)

- Professional advice from someone who knows what they are talking about

Cons

- Misleading promotions

- No track record provided

- Costs a fair amount of money

- Risk involved (as there is with any sort of investment opportunity)

- Lots of complaints about the newsletter and company behind it

Final Thoughts

Is Money Map Report a Scam?

Although you will hear some people calling this a scam, I'm not going to go quite that far.

It is a legitimate service provided by a legitimate company. The problem seems to be pretty much entirely stemming from their marketing tactics, which are unethical, deceptive, and very... very... scammy.

If you are able to look past these over-the-top marketing lures then you will see it's not a scam. However, some people buy into the hype and are disappointed... so I understand their reasoning for calling this all a scam.

Who Is This Best For?

This newsletter is best for someone who doesn't have much experience investing and isn't looking for any specific types of opportunities, because of how broad the focus is here.

If you lack experience and/or knowledge, or if you just want the comfort of knowing that you are following advice from a professional, then it may be worth subscribing to.

Is It Worth The Money?

The answer to this will be completely dependent on one's experience. Good returns on investments would make it worth it and vice versa... and unfortunately as you already know, we don't have access to a track record of how all past recommendations have performed.

There have been big winners that Keith has recommended and some people are very happy with the results they have gotten from following his expert advice... so it definitely can be worth the price. But investing is risky so you have to realize that you could potentially lose money too, which some people have complained about.

Another thing you have to consider is the amount of money you have to invest. If it's only a few thousand dollars that you have laying around then paying a $299 fee for a subscription will likely not be worth it at all.

Recommended: Stock Advisor - one of the very few investment advisory services I actually recommend.

What is your opinion of Money Map Report? Have you subscribed and, if so, what are your thoughts?

I like to hear back from my readers! Leave your comments and questions below 🙂

Also, feel free to check out my top picks for making money from home and this big list of 70+ ways to do so... it might be of interest to you.