Is Mauldin Economics a scam?

You can never be too careful when it comes to trusting investment recommendations, which is essentially what Mauldin Economics provides at its core.

In this review we'll be going over all you need to know about this place, or at least all that we can think of that anyone would need to know... including the various newsletter publications they offer, the man behind the company, investment performance, refunds, pros v cons and more.

- Website: mauldineconomics.com

- Founder: John Mauldin

- Type: Investment advisory firm

Mauldin Economics is an investment advisory firm founded by best-selling author & analyst, John Mauldin, along with partner Olivier Garret. The website was setup in 2012 to provide insight into the investment market so that ordinary people can follow along and, hopefully, benefit financially from effective strategies normally used by top-level money managers and not known by the general public.

Besides their popular free newsletters like Thoughts from the Frontline and paid options that subscribers can follow along with, they also offer a combination of Health & Wellness/Investment advice through their healthandwealthresearch.com site, which is a division of Mauldin Economics.

Mauldin Economics is not BBB accredited, which may be concerning for some. However, after doing a lot of digging around we have not been able to turn up much in the way of complaints.

Overall the company has a good reputation, but is by far one of the smaller investment advisory firms out there when compared to other similar places like Agora Financial.

To follow along with advice from Mauldin for free, we'll be going over the various free newsletter options they have available, or another option you have is to follow their Facebook page in which they regularly post updates.

Who Is John Mauldin?

John Mauldin is the founder of Mauldin Economics and a financial expert.

He received a lot of his initial fame/popularity from his best-selling book, "Bull's Eye Investing:...", and has been in the business of providing financial advice for over 30 years.

Not only is he a contributor to places like Forbes, Marketwatch, The Daily Reckoning and others, but he also has been able to build up quite the online following... with over 1 million monthly readers of his newsletters and quite a large number of Twitter followers, where he is fairly active.

He also appears quite often as a traditional news commentator, whether this be on CNBC and Bloomberg TV or through other, less formal, channels like YouTube.

Source: Youtube

One of John's most popular publications is his weekly, free newsletter called Thoughts from the Frontline, in which he provides insider advice to help investors navigate the increasingly complex global market to make good investment decisions.

Besides the financial expert side of things, some other things you might want to know about John include that he:

- Earned his Bachelor's degree from Rice University in 1972 and later a Master of Divinity degree from Southwestern Baptist Theological Seminary in 1974

- Lives in Texas with 7 children, 5 of whom are adopted.

- Has served on the Executive Committee of the Republican Party of Texas.

Publications

Mauldin Economics has over a dozen publications, some free and some paid subscriptions.

The publications vary on what their focus is, with the idea that any type of investor can find something they are interested in here.

As you would expect, the newsletter editors that Mauldin Economics employs come from a variety of different backgrounds. You have former financial newsletter publishers, equity analysts, money managers, former Wall Street traders and so on... all of which have quite impressive backgrounds. These editors include:

- John Mauldin

- David Galland

- Edward D'Agostino

- Jared Dillian

- Kevin Brekke

- Olivier Garret

- Patrick Cox

- Patrick Wilson

- Robert Ross

- Chris Wood

Premium Publications

- Yield Shark is a retail investment picking newsletter that focuses on high-yield investments with "reasonable risk". Subscribers can expect detailed monthly issues outlining new opportunities, trade alerts, and access to see the live portfolio of recommendations' performance.

- Editor: Robert Ross

- Cost: $199/yr

- Over My Shoulder provides 3-4 weekly reports with relevant micro and macro-economic research. These reports are considered general, but help break down what's going on in the economy and market so that you can avoid the noise and know what's important.

- Editor: Patrick Watson & John Mauldin

- Cost: $14.95/mo

- Street Freak is an aggressive stock picking newsletter that often consists of investments that aren't mainstream... going against the trend. Subscribers can expect at least 3 trade alerts per month along with the detailed monthly newsletter.

- Editor: Jared Dillian

- Cost: $2,495/yr

- The Daily Dirtnap provides (almost) daily market analysis from Jared Dillian, and actually started out when Jared was working at Lehman Brothers. Contrarian calls and creative analysis is what you can expect here. It is more for professional investors, not beginners.

- Editor: Jared Dillian

- Cost: $795/yr

- Transformational Technology Alert provides monthly reports on new or existing opportunities in the biotech industry, which usually consist of small and speculative stocks. Subscribers also receive weekly updates on portfolio performance and trade alerts.

- Editor: Patrick Cox

- Cost: $2,495/yr

- In the Money is a newsletter subscription option that is good for those with little to no experience. Subscribers receive monthly newsletter issues detailing an opportunity, weekly updates on the model portfolio, and trade alerts. [This service supposedly has a 94% success rate]

- Editor: Robert Ross

- Cost: $2,495/yr

- ETF 20/20 is obviously focused on ETF investment. Subscribers get monthly actionable advice, access to the model portfolio, and more... from the guy with plenty of ETF investment experience, Jared Dillian.

- Editor: Jared Dillian

- Cost: $99/yr

- ETF Master Class is another product for ETF enthusiasts by Jared Dillain. However, if you buy into this you don't get a subscription service... instead you get access to private recordings of an ETF Master Class the Jared hosted in front of a live audience, which is conveniently broken down into 4 modules. These include information on everything from ETF liquidity when the market crashes, to secrets that hedge fund traders use, and of course ETF trading strategies.

- Host: Jared Dillian

- Cost: $199

- Healthy Returns is published under the Maulden Economics division, Health & Wealth Research, and is focused on providing low-cost health, biotech, and pharma stock recommendations.

- Editor: Chris Woods

- Cost: $9.95/mo

- Mauldin Economics VIP is a premium service where members get access to all the newsletters listed above. However, membership only opens twice a year so it can be difficult to get in.

Free Publications

- Thoughts from the Frontline is a large-view newsletter that is sent out on a weekly basis and covers everything from economic developments, to opportunities coming up, and more specific topics like tax reform and monetary policy. Everything is fair game here and this is great if you are just looking to stay up-to-date with the big picture.

- Editor: John Maulden

- The 10th Man is a free weekly newsletter by Jared Dillian. Subscribers get insight into what's going on in the market and a look at how Jared analyzes what matters.

- Editor: Jared Dillian

- The Weekly Profit is another free weekly newsletter, but the focus of this one is US and world events... and more specifically how you can leverage big events to make money in the market.

- Editor: Robert Ross

- A Rich Life is a weekly newsletter with a focus on health and wealth. Not only are investment opportunities in the healthcare industry looked at, but actionable health advice is provided.

- Editor: Chris Wood

Prices

A list of the prices of their premium publications include:

- $199/yr for Yield Shark

- $14.95/mo for Over My Shoulder

- $2,495/yr for Street Freak

- $795 for The Daily Dirtnap

- $2,495 for Transformational Technology Alert

- $2,495/yr for In The Money

- $99/yr for ETF 20/20

- $199 for ETF Master Class

- $9.95/mo for Healthy Returns

Big differences in price

Obviously the paid, premium publications are going to provide more detailed information and require a lot more work on Mauldin's end than the free newsletters.

In short, you get what you pay for.

For example: Yield Shark and Street Freak have the same basic layout... with a monthly newsletter and trade alerts at their cores... but the prices are $199/yr versus $2,495/yr... largely due to the differing levels of information provided and the efforts made to provide such information (Yield Shark is more basic and more geared for beginners).

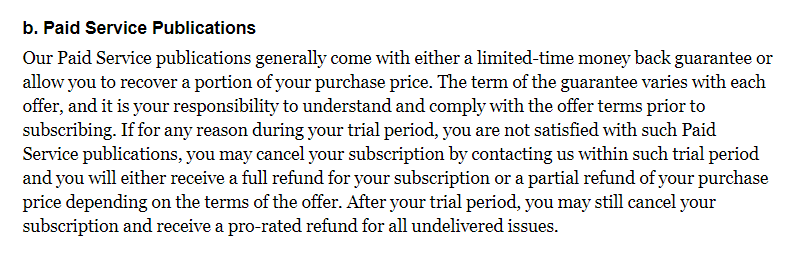

Refund Policy

The refund policy differs depending on your purchase. Generally speaking, most subscriptions come with a 30-day money-back guarantee where you can get a 100% refund if you are not satisfied within 30 days, as stated in the Terms of Service...

[Source: MauldenEconomics.com]

However, some of the monthly paid subscription newsletter services do not have this 30-day money-back guarantee--but these newsletters you can simply cancel during any given month. And newsletters like Transformational Technology Alert come with a 90-day money-back guarantee... even better.

*Information on these guarantees can usually be found right above where you enter purchase information.

Contact Info for Cancelling:

You can contact their customer service team Monday-Friday 7:00am-4:00pm (Arizona Time) at the following phone numbers:

- (877) 631-6311 toll-free

- (602) 626-3100 local

Or, your other option is to email them at subscribers@mauldineconomics.com.

They also have a contact form you can fill out on their Contact Page, mauldineconomics.com/contact-us, but this is more for general inquiries.

Performance

Of course in the promotions they always boast about large returns they've made on specific recommendations. But this isn't what we are interested in here.

We want to know overall performance. Sure, big profits might have been obtained from one recommendation, but what about losing recommendations?

What has the overall performance been like?

Unfortunately there isn't much information to go off of here. But what we do know is that:

- As of June 2019, the recommendations made through Yield Shark have given subscribers and average return of 8% over the previous 12 months, much higher than the S&P 500 during period

*The recommendations made through Robert Ross' Yield Shark newsletter are analyzed on over 75 different qualitative and quantitative criteria through a system he developed called Economics Equity Evaluation System.

- The Daily Dirtnap has an Investment Performance rating of 3 out of 5 stars on StockGumshoe, but more details are not provided.

- Transformational Technology Alert has a low Investment Performance of less than 2 out of 5 stars on StockGumshoe, but this is based on an overall low number of ratings.

- According to Mauldin Economics, Robert’s rate of success has been a whopping 94% since inception of In the Money in 2016 (now what "success" is defined as, we don't know)

Based on our analysis the recommendations made through the various newsletters offered seem to be of high quality, generally speaking.

After all, if subscribers spend up to $2,495/yr on a newsletter that ends up losing them money, they are normally more than happy to jump on the computer and complain about it on sites like PissedConsumer, Complaints Board, or with the BBB... but we do not see this kind of thing happening and this is a very good sign.

Disclaimer

It's always important to read the disclaimer when it comes to financial advice agencies like this.

We are told that all information in their publications is "believed to be reliable", but that "its accuracy cannot be guaranteed". And we are also told that the information provided is not "individual investment advice".

[Source: mauldineconomics.com]

The reason we bring this up is because it can be somewhat unnerving for some.

However, this is completely normal and necessary. They need to state that this is not "individual" investment advice because they do not know anyone's current situation--and there is always a chance that false information can get out and disrupt the markets... which is why they say the info is "believed to be reliable".

Nothing alarming here... just the necessary disclaimer.

Pros v Cons

Pros

- Newsletter options for all types of investors, from beginner to professional

- All editors have extensive knowledge in the fields they provide recommendations and predictions in

- The marketing around Mauldin Economics' newsletters is honest and not misleading like you often see

- Free newsletters provide good quality information, without being 'salesy'

Cons

- Can get expensive, with some publications costing as much as $2,495/yr

- Risk involved, as there is with any investment opportunity

- Need money upfront to invest (obviously) in any recommendations made

Is Mauldin Economics a Scam?

No, this place is not a scam in any way.

Although they are not accredited by the BBB, this certainly doesn't mean they are a scam, and based on the lack of complaints found it appears they are one of the more trustworthy financial newsletter publishers out there.

You won't see Mauldin Economics creating misleading teasers like "American Superpower Checks" to lure people into their newsletter subscriptions... which is all too common in the investment newsletter space.

Final Thoughts

There are many different financial advisory agencies out there that provide similar services to Mauldin Economics, such as Agora Financial, Banyin Hill, The Oxford Club, and others. They all provide newsletters in similar fashion... but Mauldin Economics seems to be one of the better choices without a doubt. And the reasoning here largely has to do with the high number of customer complaints you find for places like Agora Financial, and the overall lack of complaints for Mauldin--a very good sign (The Oxford Club is also a good choice).

It's understandable that you may be hesitant to make a purchase if you are thinking about buying into one of their premium subscriptions. There is always some risk involved, but this is the type of advisory agency that appears to be of the trustworthy variety... which is what you want.

Just be sure to always do your own research on recommendations made. Never follow advice blindly, even with my #1 recommended advisory service you don't want to just blindly follow along. And NEVER invest more than you can afford to lose.

Now it's your turn: What do you think about Mauldin Economics and their newsletter subscriptions?

Please leave any comments or questions below. We like to hear back from our readers 🙂

Thanks for the review!

This was really helpful.. I was about to subscribe to Raging Bull and I have changed my mind.

Thanks for the info / review I intend to purchase Mauldin newsletter as a result

Cheers

Have been a Mauldin subscriber for over ten years and am well satisfied with

Content and a bit richer!

Mauldin is a con artist and fool. Don’t waste your money.

hi – thanks for the info. i will be starting off with some of their free newsletters. would like to send some $ your way, so do you have any similar articles on canadian investment advice (i am canadian). great to see you are ‘making’ your future. be discerning though, because trouble is coming.

I am a finance professor with a Ph.D. in finance and a Masters Degree in Economics from a very prestigious University. I have been reading Mauldin for over ten years. I have learned a great deal from him. I advise all of my students to read Mauldin’s “Thoughts from the Frontline” to help them get a better understanding of the world. I am not sure what Gary, above, is smoking but I have not seen anything that suggests Mauldin is a con artist and a fool. I think I would apply those words to Gary, not Mauldin.