Is Jim Fink's Options for Income a scam advisory service that would be best to avoid? Or can you really average a profit of $5,629 each month like he says??...

One thing I've learned about investment advisory services like this is that you should never trust the promotional material, which is often misleading and makes the opportunity sound much better than it really is.

It is true that this Options for Income service has a 85% win rate, as they brag about, but this really isn't as good as it seems... as I'll go over.

In this review I'll be going over what exactly Options for Income is, what you get, performance, complaints, pros v cons and more.

Do yourself a favor and read it over before buying into this.

Overview

- Product Name: Options for Income

- Type: Investment advisory service

- Advisor: Jim Fink

- Cost: $3,000/yr

What Is Options for Income?

Options for Income is a follow-along style investment advisory service that, in a nutshell, tells subscribers what to invest in and when to invest in it. Additionally, subscribers are provided with access to a forum for communication with other subscribers, video training for newbies, and more.

In particular, this advisory service is focused on options trading, and it is promoted as having a 85% win rate with such (but this is misleading).

*Other similar follow-along options trading advisory services include The 1450 Club and Strategic Trader.

Who Is Behind It?

[Source: Business Insider]

Jim Fink is the analyst that runs this advisory service. He works for InvestingDaily, which is the company behind it all, and is an analyst/strategist at the company.

As far as experience goes, he has also worked as an analyst for Motley Fool and got into the realm of investing after finding out it was much more profitable than what he was doing at the time, which was working in telecommunications regulatory law.

To-date, Jim has over 20 years of experience trading options and runs several investment advisory services at InvestingDaily, Options for Income just being one of them.

Besides the investing side of things, it's also worth mentioning that Jim holds degrees from Yale, Harvard, Columbia University, and University of Virginia... in law, business, and more. Pretty impressive.

Is Options for Income a Scam?

Options for Income is not a scam, contrary to many of the reviews you may find online.

That said, I can see why people are calling it a scam and I'll be discussing this in more detail... which mainly has to do with the deceptive promotional content used to lure in new subscribers.

How It Works

As mentioned, this advisory service is all about options trading, which is when you purchase the right to purchase shares of a stock at a future price and date.

Below is a short informative video about options that I suggest watching if you are confused by it.

As a subscriber you will be provided with new trade recommendations regularly, on a weekly basis, along with alerts on when to exit trades or new opportunities that arise.

There is no experience or knowledge needed to get started with this service. Even if you are completely new to options trading there is a video training series provided that goes over the basics of getting started.

The Strategy

As mentioned in the sales material, Jim's strategy with Options for Income is to focus on selling options, which he claims makes it so that the "odds of winning tilt heavily in your favor".

He also claims it is less risky, which is true. Selling options is less risky than buying them when done the right way, and buyers have much lower loss potential than if they were to buy the actual stock.

To take full advantage of the recommendations, Jim recommends that subscribers do 10 options contracts per trade, which will result in the need for a substantially sized portfolio if you want to actually follow along to a T.

What You Get

I already talked about how subscribers get recommendations and training, but here I'll put everything in a list to make it easier to understand.

- Weekly Recommendations - Jim recommends 1-2 trades every Thursday, along with step-by-step instructions for executing the trade.

- Alerts - If there is a certain time to enter or exit a trade, or if a new window just opened up, subscribers are sent alerts.

- Message Board - Subscribers get access to the "Stock Talk" message board. This is a forum where you can interact with other subscribers and share strategies/successes, or ask questions.

- Members Area Access - All past trade recommendations, special reports, analyses, etc. will be available for viewing in the members area of the website you get access to.

- Video Training - There is also a library of video training where Jim walks through his trading strategies and also provides beginner info for those just getting started.

Cost & Refunds

The price isn't cheap. This is one of InvestingDaily's premium services and it costs $3,000 per year to subscribe.

Refunds

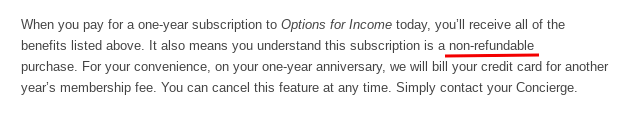

Additionally, there are NO refunds, as it states below the checkout area on the website...

Why no refunds? Well, because they say that as soon as you become a member you instantly receive benefits... so they don't think it's appropriate to give refunds... which I think is a load of crap.

With a completely digital service like this it would be incredibly easy to give out refunds. At least giving out pro-rated refunds would be nice to see, but this doesn't happen.

That said, if you did subscribe and would like to try your luck, you can contact the customer service team at (800) 543-2051.

Performance

The most important thing of all... performance. Of course the reason anyone subscribes to an advisory service like this is to be provided with good actionable trades... and to make money.

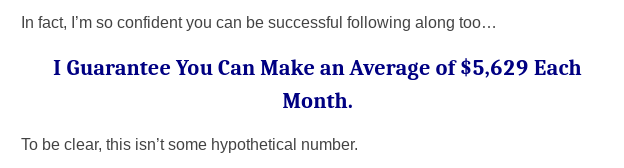

Jim states that he guarantees "you can make an average of $5,629 each month", but I'm not so sure I'd believe this statement.

"We make money on 85% of our trades"

This is another statement made by Jim, which is true... however it is misleading.

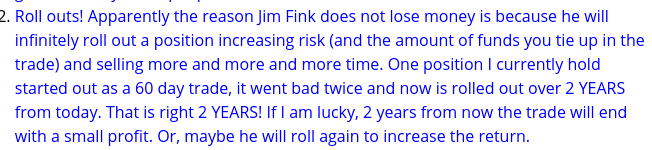

As mentioned in multiple subscriber reviews I found online, Jim almost never backs out of a trade when it goes bad... but instead throws more capital into it and keeps rolling them out... which can lead to significant amounts of money being tied up in a single trade that can last... well... years!, as mentioned by a subscriber here...

[Source: UnderpaidOverworked.com]

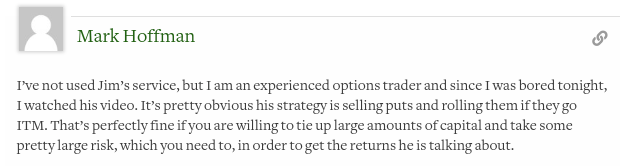

... and as also mentioned by a self-proclaimed experienced options trader who decided to give his 2 cents on Jim's strategy...

[Source: Stock Gumshoe]

Don't Expect Big Profits!

Even though the win percentage is quite high, this doesn't mean you are going to be walking away with a fat wallet.

With this trading strategy per-contract losses are significantly higher than per-contract profits, which means that even wining 85% of the time and lead to losses overall.

In a review from a subscriber (at UnderpaidOverworked.com) they did the math on trades made during a period of time and found that the average per-contract profit was $91.25 and the average per-contract loss was $618.91, which led to a loss overall, even though the win rate was 80%.

Results will vary of course, but this goes to show that things aren't always as they seem... and in this case a 80% win rate wasn't even good enough.

Complaints

Misleading Advertising - The advertising for this service is a bit over-the-top, and misleading, to say the least.

As many angry subscribers I'm sure can attest to... the service isn't exactly what they expected before joining.

No Refunds - As mentioned, there are no refunds... and I think there definitely should be considering how misleading the advertising is... and considering the fact that providing refunds is very easy with a service like this.

Need Significant Sum of Money to Follow Along - Jim recommends 2 new trades every week and suggests using 10 contracts per trade... and on top of that he continues to roll out trades if they go bad... which really adds up. To actually follow his recommendations and strategy to a T you would need a significant amount of money in your brokerage account... close to $100k.

Rolling Out Trades - Rolling out trades can work out to your benefit at times, but leads to increased risk in single trades and a lot of money being tied-up that could possibly be better used in new trades.

This kind of strategy isn't the best.

Losing Money on Bad Recommendations - When people lose money with advisory services like this it is expected that they'll complain about it... especially when they lose significant amounts of money, as some have with Options for Income. Below are some reviews of Options for Income on Stock Gumshoe that are pretty disturbing...

[Source: Stock Gumshoe]

[Source: Stock Gumshoe]

[Source: Stock Gumshoe]

You certainly won't hear about losses like this in the promotional material.

Pros v Cons

Pros

- Easy to follow

- No experience needed

- Options trading requires less capital (lower barrier of entry vs trading stocks)

- High win percentage

Cons

- Risky strategy (per-contract losses are significantly higher than per-contract profits)

- Rolling out trades can require a lot of capital (which many subscribers probably won't have)

- Misleading advertising

- Expensive subscription price

- No refunds

Conclusion - Worth Subscribing To?

While the decision of subscribing to this advisory service is ultimately up to you, I will not be promoting it here on my website, that's for sure. There are just too many complaints and too many people who have lost significant amounts of money following along.

It is true that many of the large losses people have experienced could have come from the same trade recommendations, and things may seem worse than they actually are, but the bottom line is that with an advisory service like this massive losses need to be avoided... and they clearly haven't been.

The service obviously has value and I'm sure Jim puts a lot of time into it, but it doesn't really seem to be worth the price tag.

But anyways... you decide for yourself. I hope you found this review helpful, and, if so... please share this post to spread the word and to help out my website here.

Also leave any comments/questions below and I'll get back to you soon 🙂

I was one of Jim’s first five subscribers back in April, 2011. Over the first five or so years I made almost a quarter of a million dollars, or at least I thought I had. That was my net profit on ‘closed’ trades. I also never trades 10 contracts, rather, beginning in 2011 with one and getting up to a maximum of five a few years later.

So yes, I made a lot of money. Matter of fact Jim used my results in his promotion frequently over the years…and still may be doing so.

Somewhere about 2016 or so, I began to realize that I had a boat load of trades that were just simmering along. Fortunately, I almost never flipped credit put spreads to calls when Jim recommended that fix. I also almost never doubled my risk when rolling down, rather, would begin working out of trades. Both of these actions were different than what Jim recommends…but worked for me.

I am older and realized last year that digging the hole deeper on what could be 40 or 50 trades wasn’t in my best interest, so I left OFI after 8 years and now trade a few conservative index trades each week. Not making as much money as I once did with Jim, but sleep much better at night.

I wouldn’t say Jim’s service is a scam, rather, that it can be very profitable. A bit of that depends on the market and also whether an individual is confident in varying from Jim’s way once in awhile. Also found your comments ‘cons’ to be accurate. Interesting read.

Hi Roger. Thank you for the informative comment. I’m sure it will help other readers with their decision of whether or not to get involved. It’s always good to hear from insiders like you.

Hi, thanks for the review, I have not decided what to do yet, I am not an experienced investor, but getting some advice or second opinions is always my way of doing things most of the time. I will look at some other reviews but yours was very informative and had good pros and cons listed. One of the big finds in your review was the length of some of trade times and the capital that will be tied to it. Another is the lose / win per trade percentage which turns into real dollars +/- . Thanks for info.

Hey Kyle,

Thanks for all the informative reviews you provide. Is there any Options Advisory that you would recommend? Something that can accommodate a $10,000 portfolio.

Thanks,

Victor.

Hi there can you please provide more background on your own service Legendary Wallet?

Thank you

I am trying to get clarification on the Stock Adviser service you recommend but can’t find a way to comment. So I am asking here.

You article says the service provides to stock picks per week but based on the write up below it sounds more like 2 per month. Please clarify which is correct and make the changes to the webpage discussing the recommendation as appropriate.

“ 2 New Stock Picks Each Week – On the first Thursday of each month Tom Gardner will make a stock recommendation, followed by David Gardner on the third Thursday of each month”

The first and third Thursday means only twice a month not a week. Am I missing something?

Thanks

Can you tell me about Jim's Velocity Trader?