Is Angel Publishing a legit investment research service that you can trust? Or, should you avoid this place like the plague?

These questions aren't at all over-the-top, and should be asked. After all, with all the scammy investment teasers and opportunities out there, you can never be too sure.

Luckily, you're in the right place. In this review of Angel Publishing we'll be going over what every investor should know beforehand, such as what services the company offers, costs, their refund policy, complaints and more.

Let's begin...

Overview

- Company: Angel Publishing

- Type: Financial advisory firm

- Products: Investment newsletters

- Website: angelpub.com

- Social Networks: Facebook page, LinkedIn

What Is Angel Publishing?

Angel Publishing (aka Angel Financial) is an investment advisory firm based in Baltimore, Maryland. In a nutshell, the company provides market analysis and investment recommendations to subscribers of their various newsletter services.

The core of this company is rooted in the beliefs of power in individuals, free markets, and limited government - and so their target audience leans more to the conservative side.

At first glance things seem decent. They have an A- rating with the BBB (pretty darn good), not that this matters all that much, and not too many complaints. However, there are complaints and we'll be going over what you need to know later in this review.

Who's Running the Show?

The team at Angel Publishing consists of a number of advisors/analysts/experts. They have different expertise and methods/strategies, but they all have one thing in common... they all are towards the conservative end of the spectrum and are big advocates for free-markets and limited government.

The team of experts include the following:

- Brian Hicks - He has been featured on CNBC, Bloomberg, Fox News, and others for this expertise. If you've heard of him, you may have heard him referred to as the "Bull on America", which is because he is often seeking investment opportunities stemming from the US economy rather than globally. Something else worth noting is that he holds a political science degree from the University of Baltimore and has graduate-level work in Political Theory.

- Christian DeHaemer - Christian (or Chris) has been providing investment advise since 1996. He travels often and brings investors first-hand reports/opinions from the front-lines. Additionally he has developed his own strategy where he looks for specific kinds of catalysts, which he calls "The Hammer, Trigger, and Spark System", before investing. He is known for recommending opportunities most people wouldn't touch.

- Briton Ryle - Briton is old-school. He makes use of fundamental and technical analysis before providing recommendations. He's been working as an advisor since 1998 and primarily focuses on dividend growth stocks and REITs.

- Jeff Siegel - Jeff Siegel is a financial writer with a lot of expertise in the renewable energy and cannabis fields. He also authored the best-selling book Investing in Renewable Energy: Making Money on Green Chip Stocks, and, believe it or not, is a musician as well.

- Jason Stutman - He is the senior technology analyst at Angel Financial and provides recommendations based on technology trends. His strategy is simple: buy the disruptor, sell the disrupted.

- Alex Koyfman - Alex holds a JD degree from Penn State. He's originally from the Soviet Union, but immigrated to the US in the early 80's. With a law degree under his belt, it's understandable that he takes a more scientific, methodical approach towards investing - and currently provides recommendations for technology and resource companies.

- Keith Kohl - This guy is an energy markets insider. He travels around meeting with industry insiders and gathering information from the sources.

*Note: The information on some of these experts is limited. Some seem to have reputable backgrounds with years of experience and good educations, while others not-so-much.

Other FAQ's

Is Angel Publishing Legit?

Yes, Angel Publishing is a legitimate company and provides legitimate investment newsletter services.

Can You Trust Their Advice?

As with any sort of investment opportunity, one should always perform their own due diligence. While some of their services tell investors specifically what to invest in, you should never just blindly follow advice.

Are Refunds Available?

Yes, refunds are available, but the policy differs depending on the service purchased. Some services have no clear refund policy.

What They Provide

What Angel Publishing provides is market analysis, commentary, and specific investment recommendations through a variety of services. These services can be broken down into two categories: free and paid (premium).

1. Free Publications

- Wealth Daily - This is their flagship newsletter service. It was founded in 2005 and provides broad-level market analyses and commentary. Subscribers receive email newsletters six days a week that provide all sorts of information, ranging from new investment ideas, to strategies and insights, etc. Additionally, you can go to the website, wealthdaily.com, to read through recent publications.

- Energy and Capital - Was also founded in 2005, but this newsletter is focused on the energy sector in particular and new investment opportunities (and what you should avoid). From oil crises, to natural gas drilling regulations, to electric cars and more... anything dealing with energy is on the table here. This service also has a website of its own at energyandcapital.com.

*Note: These free publications are good for broad, high-level oversight on what's going on and how things may effect the markets. However, they do not provide specific investment recommendations, as do the premium publications. If you do subscribe to one of these, you will receive a lot of promotions for their other services.

2. Premium Publications

- Green Chip Stocks ($249/yr) - Investment opportunities that are "green", such as in the renewable energy, cannabis, and organic foods sectors. Also places a big focus on social issues and companies with upside in this space. Members get weekly investment recommendations, market analyses, updates and more.

- Editor: Jeff Siegel

- Technology and Opportunity ($249/yr) - Focuses on new opportunities in the tech world, which could be dealing with anything from AI to 5G technology. Members get monthly issues of this report with new recommendations, portfolio updates, alerts when it's time to sell, weekly market analyses, and more.

- Editor: Jason Stutman

- Bull and Bust Report ($149/yr) - Focus is on providing financial safety even in times of possible financial disaster. When crises hit, this report shows investors how to capitalize on them. Members get monthly newsletter issues that provide new recommendations, weekly updates on the market and investments, alerts when it's time to buy/sell, access to the model portfolio and more.

- Editor: Christian DeHaemer

- Energy Investor - Newsletter service focused on new opportunities in the energy sector. Targets energy trends of all different sorts. Members are provided with investment recommendations, updates, alerts, model portfolio access and more.

- Editor: Keith Kohl

- The Wealth Advisory ($249/yr) - Goal is to help members build long-term wealth for retirement. No short-term plays here. Members get monthly issues of the newsletter with new research and at least one new recommendation, portfolio updates, alerts when a trade should be made, etc.

- Editor: Briton Ryle

- Alpha Profit Machine (Currently Unavailable) - Uses a special algorithm that looks for early signs of stocks that have the potential to soar. Members are alerted.

- Penny Stock Millionaire ($1,999/yr) - For those looking for potentially quick profits from penny stocks. Focused on the tech and biotech industries. Members receive weekly issues of the newsletter, buy/sell alerts, specifics on the target prices, research and analyses, etc.

- Editor: Alex Koyfman

- IPO Authority ($149/yr) - Look for new IPO offers that look like solid investments. Gives members a chance to get in on companies before they hit the public market. Members receive weekly IPO updates, monthly recommendations on the best IPOs, regular updates and more.

- Editor: Jason Stutman

- Pure Energy Trader ($1,499/yr) - Good for those looking to profit in the energy market, which can be volatile and has the potential for fast profits, but can be risky too. Members get monthly newsletters that provide recommendations and analyses, trade alerts, portfolio updates, etc.

- Editor: Keith Khol

- First Call - Targets small-cap companies that are still in their infancy, but have potential to be name-brands in the future. This service is for those who are looking for aggressive returns and aren't afraid of a little risk. Specific investment recommendations and updates are provided to members.

- Editor: Alex Koyfman

- Private Intel ($4,999/yr) - It's expensive, but provides members with new opportunities before they go public. All industries are fair game here, as long as the opportunity is good. Members receive profit alerts when it's time to buy/sell, portfolio updates, market analyses, and more.

- Editor: Jeff Siegel

- Weekly Score ($1,999/yr) - Provides quick profit opportunities in any market. Each week a new quick-trade opportunity is provided. Members also receive regular updates/analyses and alerts on when to sell.

- Editor: Jeff Siegel

- Topline Trader ($4,999/yr) - New drug developments provide huge investment opportunities, and this is the focus here. The analysts behind this service look for small stocks and catalysts that provide big potential. Members receive access to their interactive FDA and drug development calendar, biotech stock and catalyst alerts/analyses weekly, regular recommendations, analyses of drug trials, chances of success analyses, options trading strategies to increase profits and more.

- Editor: Jason Stutman

- Real Income Trader ($4,999/yr) - Quick profit opportunity service. Claims that weekly income is guaranteed and transactions only take 8 minutes on average. Members are provided with a monthly newsletter that goes over new recommendations and gives analyse, trade alerts, etc.

- Editor: Briton Ryle

- Wealth Trust (price not listed) - Provides access to all premium subscription services listed. This is their top-tier subscription. Members get access to all type of opportunities and trading strategies.

Cost and Refunds

The costs of the publications vary greatly, as you can see. The cheapest options are $149/yr and they get as expensive as $5k/yr.

The refund policy, apparently differs depending on what subscription you purchase.

It's a bit confusing, but in the terms of service they state that customers have 10 days to request a refund after purchase. However, with some of the publications, such as Bull and Bust Report, there is a 30-day money-back guarantee. Some even come with more obscure guarantees, such as The Weekly Score's "100% Ironclad Guarantee" that says you can request a full refund within a year if the services doesn't "deliver at least 20 double-digit winners within one year".

The refund policy is confusing to say the least. Some publications don't even mention refunds on their order pages - so does this mean the 10-day policy discussed in their terms of service applies? We aren't 100% sure.

That said, their customer service team can be reached at:

- (877) 303-4529

- customerservice@angelpub.com

Their hours are 9:30 a.m. and 4:00 p.m. Eastern time.

It may be worth it to contact them before you purchase anything to see about potential refunds.

Note: Subscription will auto-renew, meaning your credit card will be charged automatically after the subscription expires, unless you cancel.

Track-Record

Once subscribed to one of their paid services you will have access to a model portfolio where you can monitor the performance of investment recommendations. However, this information is not available to the public and there is no good way to get a clear picture at how well their services are performing overall before actually investing.

Sure, we can see past trades they show us in the promotional material, but of course they are only showing us the good side here.

That said, based on subscriber reviews we have read, the overall performance seems to be fairly good, but of course performance will vary depending on many factors, such as the market, expert providing the recommendations, and so on.

There is always risk involved when investing. Even when following "expert" opinions we always recommend doing your own due diligence.

Complaints/Concerns

#1 - Poor Customer Service

There have been multiple complaints about the customer service provided by Angel Publishing, with some people having difficulty canceling memberships because of it. The complaint below is from a subscriber who claims every time they call the line is busy...

[Source: BBB.org]

*Note: We tried our luck and didn't have any problem reaching customer service. There was a brief hold for several minutes, but we were able to get through. That said, we are't sure how well trained and competent the team is.

#2 - Deceptive Marketing Practices

Some people have complained about deceptive marketing tactics this company uses, with this person claiming the company "preys on individuals"...

[Source: BBB.org]

And another person claiming the company "takes advantage of the elderly"...

[Source: Google Reviews]

If you've seen promotional material for any of their services, you'd likely agree that this can be misleading/deceptive to some extent.

#3 - Generic Information

One complaint we found is from someone who claims the "information is generic" that they provide. However, we don't know which of the services they signed up for, and really can't provide an opinion on it. After all, their free and cheaper services do provide more basic, generic information than the higher priced services.

[Source: Reviewopedia.com]

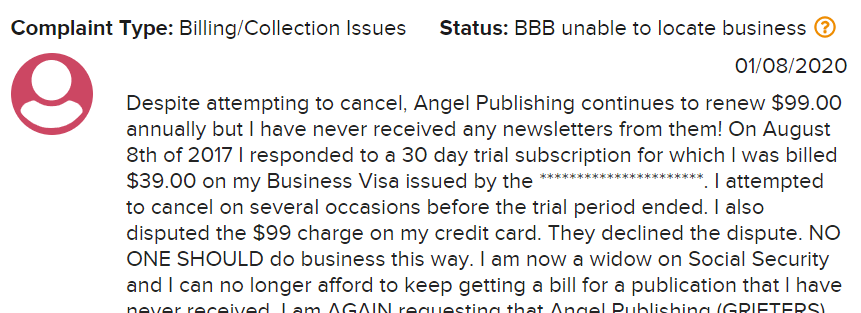

#4 - Unauthorized Charges

Some people have complained about receiving unauthorized charges from Angel Publishing. The complainer below claims that they keep getting charged $99 for a newsletter they have never received and have tried to cancel...

[Source: BBB.org]

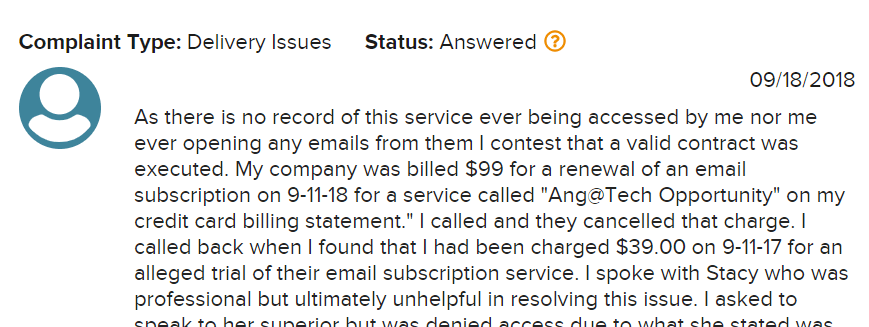

And another complaint is from someone who was charged by the company but has no recollection of every signing up for anything...

[Source: BBB.org]

#5 - No Pump & Dump Safeguard Policy

Something we noticed is that Angel Publishing has no safeguard policy in their terms of service that protects against pump & dumps.

For example, other investment advisory firms like The Oxford Club prohibit their employees, which include editors/analysts/experts, from investing in recommendations before they are published. This way the people running the newsletters don't have the incentive to pump small-cap stocks for quick profits.

Angel Publishing has no such policy. This isn't to say that they are engaging in such activity, but it is a concern nonetheless.

We actually recently wrote a post about the possibility of Motley Fool being a pump & dump.

#6 - Refund Policy Could Use a Tune-up

The refund policy should be made more clear. As discussed above, the refund policy varies depending on the service and some services make no mention of any refunds. It can get confusing.

What We Like/Don't Like

Like

- Easy-to-follow and well laid-out publications

- Variety of different investment services offered, good for just about any type of investor

- Fairly reputable group of experts on the team

- Good for finding hidden opportunities you won't hear much about in the media

Don't Like

- Refund policy is confusing

- No pump & dump protection policy

- Promotions can be a bit over-the-top and misleading

- Customer service is poor

Conclusion - Should You Subscribe?

Just a quick recap: Angel Publishing is a Baltimore-based investment advisory firm that provides investment newsletter services... with many of their services being "follow-along" style where investors are told what to invest in and when.

Getting professionally-recommended investment advice that is easy to follow along with sounds amazing, but we can't answer the question of whether or not you should subscribe to one of their services. This depends on what you are looking for and your situation.

Overall their reputation is okay, but we can't really recommend them with confidence do to the lack of a transparent track-record. If you are looking for a reputable investment advisory service with a good track-record then we recommend Stock Advisor.

Now it's your turn: What do you think of Angel Publishing? Do you have any comments or insight you can share? Let us know below.

Thanks for your research into Angel Publishing. It will help in my decision to subscribe.

Did you subscribe? And how was it?

Thank you