Oxford Bond Advantage is promoted as a way to make large returns off of bond investments, sometimes up to 400% or more. But is it really all that great or is this just another over-the-top sales pitch?

Is Oxford Bond Advantage possibly a scam that you would be better off avoiding?

One thing is for certain... the marketing material is a bit far-fetched. In this review I'll be going over what exactly this newsletter is, what it provides, complaints, pros v cons and more.

Enjoy...

What Is Oxford Bond Advantage?

- Name: Oxford Bond Advantage

- Product Type: Investment newsletter

- Chief Editor: Steve McDonald

- Publisher: The Oxford Club

- Cost to Subscribe: $4,000/yr

- Recommended?: For some (more on this)

Overview

Oxford Bond Advantage is an investment newsletter published by The Oxford Club with Steve McDonald as chief editor. It is considered one of their higher-end products, being a "VIP Trading Service" that costs $4,000 for a year's subscription.

In a nutshell, with this service you are provided with investment recommendations from Steve McDonald and can follow along without any previous experience or knowledge. You will also be provided with educational content so that you know exactly how to go about investing in your brokerage--making this a good choice for someone who has extra money laying around but lacks knowledge in investing and/or would like to be guided by an expert.

Focus of the Newsletter

Obviously the focus is on bonds, but in particular it is mostly on ultra-short maturity corporate bonds... bonds that can provide you with high returns in short periods of time, which isn't what you would usually think of when it comes to bond investments.

Company Background

The publisher of this newsletter is The Oxford Club, which is a financial newsletter service based out of Baltimore Maryland that has been around for over 30 years, making it one of the longest running newsletter services out there.

Besides Oxford Bond Advantage they publish a number of other newsletters and have other chief editors working for them.

Overall they have a pretty good reputation and are a legitimate company, although you will find a number of complaints if you do a little research.

The Teasers

There is a good chance you have come across one of the teasers by Steve McDonald that lure you into subscribing to Oxford Bond Advantage.

There have been plenty in the past and will continue to be more in the future, but they all are laid out in the same general fashion.

Right now there is a teaser for "super bonds" that can bring in up to 400% returns...

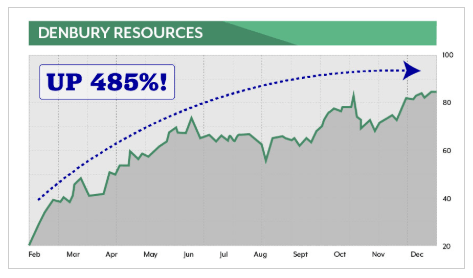

About 25% of the teaser is made up of charts of past returns like this... which show massive profits...

And of course there is the angle used where he makes it almost seem that we are guaranteed to make tons of money with these "super bonds"... because we will get a "legally binding contract"...

All of the information on how to get in on one of these opportunities is in his report, which we are told is free...

BUT... you can only get the "free" report if, and only if, you subscribe to his Oxford Bond Advantage newsletter.

So is it really free? Well... you be the judge.

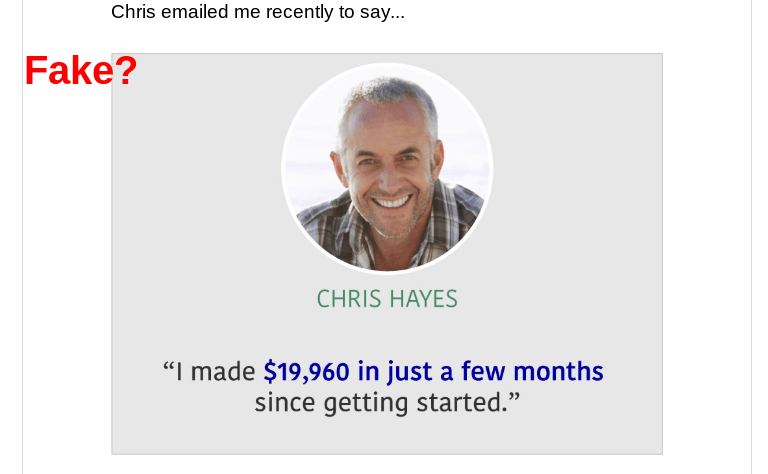

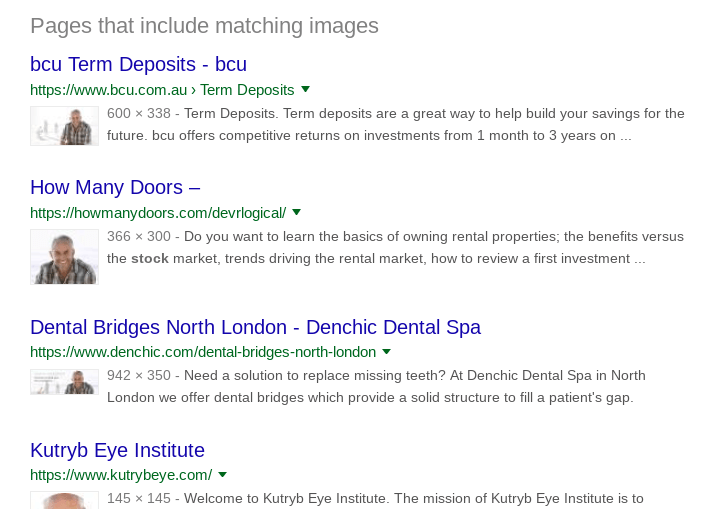

Side Note: The testimonials given in the teaser are likely fake..

I ran a quick reverse Google image search and found that the images used in these testimonials are more than likely stock photos, because they are used all over the internet...

So ya... the teasers for newsletters like this are ridiculous. This is something just about every investment newsletter I have come across has in common.

However, I know that you can't always judge a book by it's cover and while some financial newsletters are junk, some are well worth the subscription.

So let's start by taking a look at what you actually get as a subscriber.

What You Get as a Subscriber

1. Video Tutorials - One of the first things you will see when you login to the members area is a quick start video, which will basically go over how everything works. There is also a video library that consists of 5 video tutorials to help walk you through the process of investing in bonds so that you know exactly what to do when it comes time to go in on one of his recommendations.

2. Monthly Trade Alerts - On a monthly basis you will get an email focusing on a new "super bond" opportunity. You will be provided with all the details on why Steve thinks it's a good opportunity and will know how much of a return you can expect on your investment before you invest your money, which is really nice. He will also inform you how to find the bond in your brokerage to make things as easy as possible.

3. Portfolio Updates - You will also get updates on the recommended bond picks that are in the model portfolio. Steve will talk about how things are going and also give his market analysis as to what direction he sees the marketing going in the future. It states that you will get these updates 2-3 times a month.

4. Video Briefings - At times you will receive "breaking opportunity" video reports where Steve goes over new opportunities, when to buy, when to sell, etc.

5. Website Access - As a subscriber you will have access to the members website. Here is where you will be able to find everything, including the video tutorials, past trade alerts, portfolio updates and so on.

6. Bonus Reports - This isn't part of the Oxford Bond Advantage but there are always some bonus reports thrown in there for new subscribers. As of writing this review some of the bonus reports new subscribers will get include "Top 3 Bonds to Buy Right Now" and of course the free report on the "super bonds" that can bring in 400% returns.

7. Dedicated Support - Because this is considered one of The Oxford Club's VIP Trading Services, I imagine their support is better than for those who subscribe to the normal low-cost newsletters. However, it's important to know that this support team is there to help with technical website issues, subscription questions, etc... not to give investment advice.

Who Exactly Is This Steve McDonald Guy?

Can you really trust the advice this guy is going to give you or is he a loony giving advice he isn't qualified to give?

Before joining the Agora, which owns The Oxford Club, Steve was a professional broker and led investment-focused workshops for conservative investors--according to TalkMarkets he led 30-40 of these... quite a lot.

He has over 20 years of experience trading stocks and bonds and his specialty is ultra-short maturity corporate bonds... which is what Oxford Bond Advantage is all about.

And, not that it matters, but before all of this Steve served in the US Navy for 8 years... which some readers I'm sure will find respectable.

Supplying subscribers to Oxford Bond Advantage with his top bond recommendations and keeping them up-to-date is his main project, but besides that Steve is also a contributor to The Oxford Income Letter and Wealthy Retirement.

While he didn't manage any billion dollar hedge funds or anything like that, he does have a good bit of experience investing himself and has been helping others make good investment choices for quite some time.

Cost

The cost to become a subscriber here is pretty significant... $4,000 a year to be exact.

There are special discounts that go on at times where you can receive some rather large price reductions, but you can't really expect this.

*Note: You will automatically be charged the following year. So if you do join, be sure to mark it on your calendar so you don't forget.

Is It Worth The Price?

This completely depends on one's individual experience. If someone makes their money back and a lot more, then it is absolutely worth it... but if not then it would not be worth a second thought.

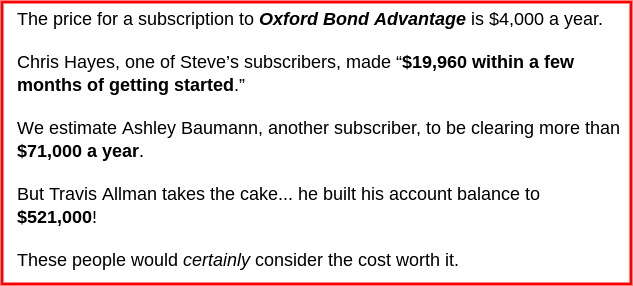

According to the one sales pitch I came across there are lots of people making loads of money off of Steve's recommendations...

... but there is no information given as to how much money these people invested initially, which could be a determinant factor.

60 Day Refund

The good news is that there is a 60 day money-back refund.

The bad news is that there is a 10% "handling fee" you won't get back, which means you will lose $400 if you request a refund.

What exactly are they handling? I have no idea but in my opinion this is a joke. Amazon, Walmart, etc. don't even charge handling fees on returns and they deal mostly with physical products that actually require "handling".

"Double Your Nest Egg" Guarantee - There is also a guarantee that Steve will "show you the opportunity to double" your nest egg. If he doesn't then you will be able to get a complete 2nd year subscription for free.

However, I'm hesitant to trust guarantees like this and I wouldn't count on ever being able to get a 2nd year free. There will always be some way that he shows in which you can double your nest egg.

Past Performance

It would be really nice if you could look at the past performance of Steve's recommendations made in Oxford Bond Advantage before forking over $4,000 to join, but unfortunately you cannot.

The newsletter has an investment performance rating of around 2.8 out of 5 stars on StockGumshoe...

... but this comes from only 32 votes from subscribers and really isn't much to go off of.

That said, Steve does seem to be a credible guy and I doubt The Oxford Club would have him working as a chief editor for them if he was making lousy picks.

There have been some complaints I will go over next from people who have lost money, but you will find complaints like this no matter what investment newsletter you look into.

*Note: The promotions are always over-the-top and a bit misleading. Never get too caught up in the marketing material, such as the "super bonds" that are going to give you 400% returns.

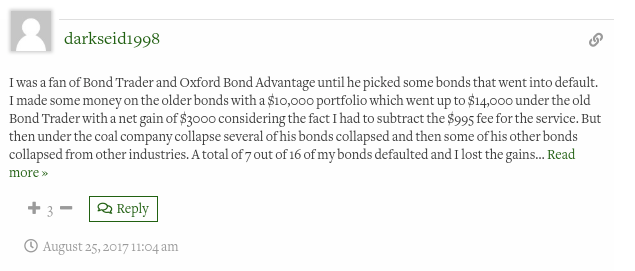

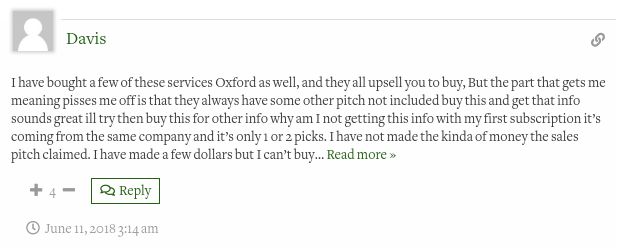

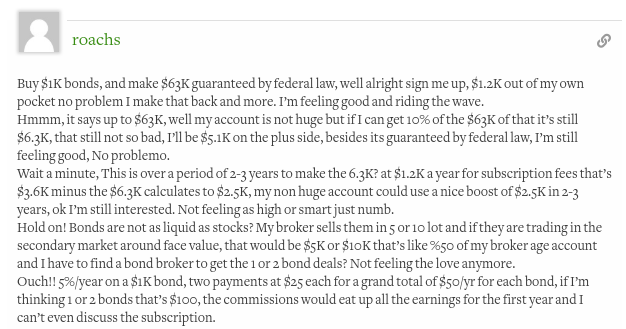

Subscriber Reviews/Complaints

When it comes to subscriber reviews and complaints, there really isn't too much to say. With the lower cost newsletters there are always boatloads of reviews that you can find online, but for the more expensive VIP Trading Services like Oxford Bond Advantage there aren't near the amount of subscribers.

There are some positive reviews but most of what I've found consists of complaints, which is somewhat expected. However, the number of complaints total is very low and many of them are years old, which is a good sign.

Some of the complaints worth mentioning include:

Losing Recommendations - Not all of Steve's picks are winners. There is risk in investing and this is something that is unavoidable.

Apparently in the past Steve was recommending a bunch of cheap coal bonds that lost subscribers money...

... but of course in the sales pitches you only hear about all the money he has helped people make. It would be nice to see a little more transparency here, but it is what it is.

Misleading Sales Pitch - The way the sales pitches for this are misleading they should expect complaints about it. People are buying into things that sound better than they really are.

And that's pretty much it.

Overall there isn't much to talk about, like I said... and this is a good sign in my opinion because people who invest $4,000 in a newsletter will be more than happy to complain about it if they are losing money... and since there aren't many complaints then I assume Steve's picks are pretty good overall.

Is Oxford Bond Advantage a Scam?

Oxford Bond Advantage is not a scam. If you are able to look past the somewhat ridiculous marketing material then you will be able to see this.

The company behind it all, The Oxford Club, wouldn't want to tarnish their reputation by scamming people with a newsletter like this. It is a legitimate service that provides real value and has many subscribers that are more than happy with their results.

Pros v Cons

Pros

- Recommendations from an expert in the industry (Steve)

- Can follow along without any knowledge or experience on investing in bonds

- Alerted to some very good opportunities

- Well laid out material

Cons

- Very expensive

- Misleading marketing material

- "Handling fee" not returned if you request a refund

- Risk involved (as with any investment opportunity)

Conclusion - Worth Subscribing To or Not?

Oxford Bond Advantage is a great newsletter to subscribe to if you lack knowledge and/or experience investing in bonds but would like to find those good opportunities that can potentially bring you some pretty impressive returns... returns much higher than you normally think of when you hear the world 'bond'--or if you just want to minimize risk by following expert advice.

Overall it seems to be a good newsletter that can be well worth the price, although $4,000 is a lot. That said, you will need money to invest and if you only have a few thousand dollars laying around to throw into this, it more than likely won't be worth it.

If high returns on ultra-short maturity corporate bonds peaks your interest, and you want to invest based on expert advice, then this could be worth a try.

If you decide it's not for you then you can always request a refund within 60 days (although there is that darn 10% "handling fee" you won't get back!).

I hope you enjoyed this review and I hope it gave you a clearer picture as to what this newsletter is and whether or not it is right for you. I like feedback from my readers so please leave any comments or questions below 🙂

Do you know of any financial advice services that you would recommend?