Blue Edge Financial's Titan G7 trading software has gained a lot of popularity lately, but is it actually legit? Does it really work and can it make you money?

If you're familiar with my site here then you know I look into different "make money" programs/systems quite a bit. Some are obvious scams that I avoid completely, but Titan G7 looked promising to me and so I decided to join Blue Edge Financial to test it out.

In this review I'll be going over what Titan G7 is, how it works, my results and more.

Let's begin...

What Is Titan G7?

- Product: Titan G7

- Type: Forex trading software

- Creator: Blue Edge Financial

- Recommended?: Yes (good results for me so far)

- Where to Buy: Official website here

Titan G7 is an EA (expert advisor) Forex trading software that uses AI to read the market and make the best trades possible. It was developed by the team at Blue Edge Financial. In a nutshell, it's an automated trading bot that you just set up and then it trades for you. There are some settings that can be adjusted, but for the most part it's something you don't really want to, or need to, mess with.

I already wrote a review on Blue Edge Financial, but I'll give a quick recap here. Blue Edge Financial is a Forex education and software company that started out in early 2020. They offer a single membership that gives you access to all their Forex training as well as Titan G7, and some other helpful tools. So far, since I joined, the team has been doing great. They are constantly testing out new settings on Titan G7 and keeping members updated via the private Facebook group as well as their Telegram channel. Overall the company behind it is very active always there to help.

How It Works

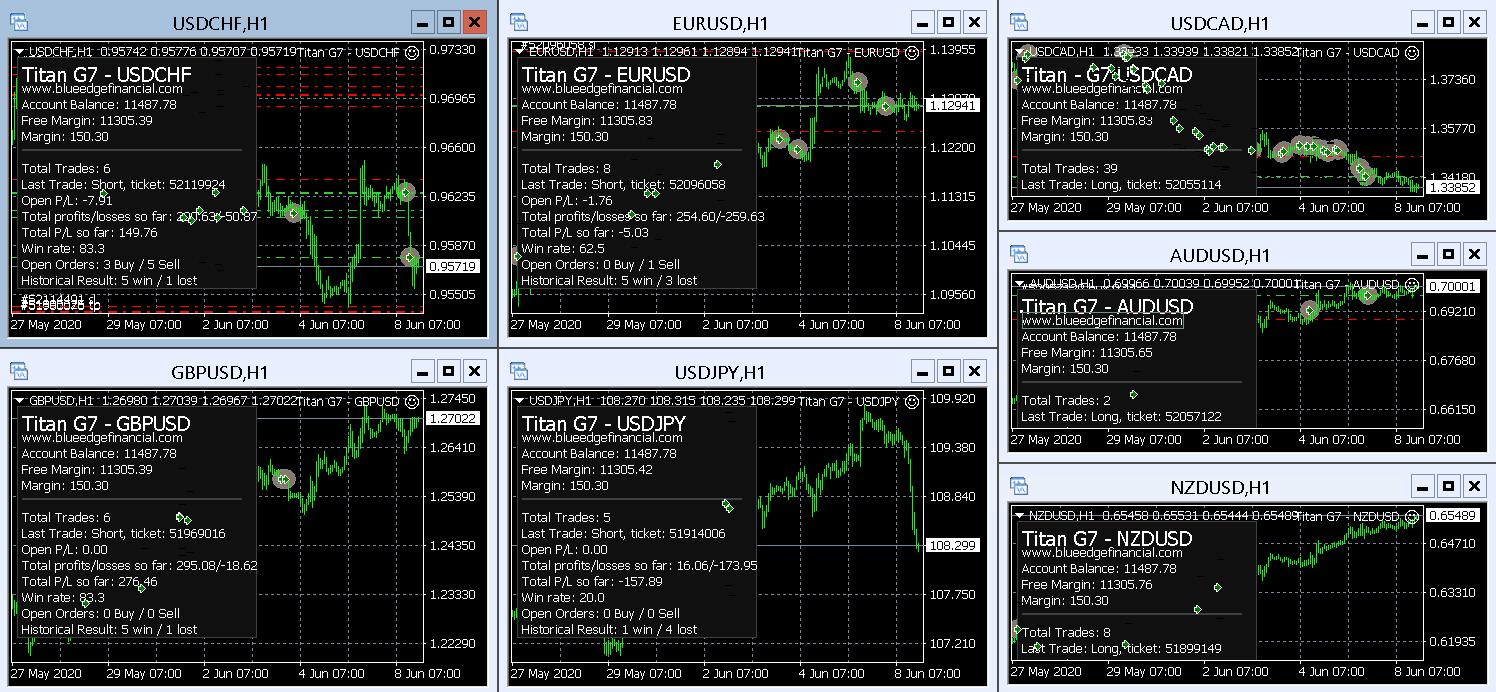

This is how Titan G7 looks when it's running...

What you see above is 7 different charts, and this is because Titan G7 trades 7 different currency pairs.

For those that don't know, Forex stands for Foreign Exchange and Forex trading just means trading between different currencies.

Titan G7 trades the 7 big currency pairs. These include:

- EURUSD

- USDJPY

- GBPUSD

- AUDUSD

- NZDUSD

- USDCAD

- USDCHF

The software trades these currencies while using 100+ different strategies in its database. It doesn't use them all at once, but the A.I. algorithm here finds out what strategies are performing best with the current market situations and uses them. This is all done thanks to the 1,000,000+ lines of code it's been built on, which is a lot more than you'll see with most trading softwares.

According to the one developer behind it, Tyler Turner, the software is using 6 different trading strategies at any given time, constantly reading the market and evaluating its options.

MetaTrader 4 (MT4)

MT4 is a popular online trading platform that is highly customizable... and it is this that the Titan G7 runs on.

I'm not a programmer and can't explain things in great detail here, but you can think of it like this: The MT4 platform is the foundation that Titan G7 is built on top of.

Now you might be thinking... well, who cares? And the reason I'm mentioning this is because you'll have to download the MT4 platform to run Titan G7. But don't worry this is easy... and free.

Risk Management Features

One of the things that makes Titan G7 so attractive to Forex traders is how it manages risk. If you've already been doing your research into it then you are probably somewhat familiar with this. There are 3 ways that come to mind right away on how it does this, some it does automatically and others you have the power to control.

- First, it uses both set take-profits and set stop-losses. This minimizes the amount you will lose even if a trade goes horribly wrong.

- Second, you will be able to adjust the lot size per trade, which can be a percentage of your account or a fixed size. This way you can control how much risk you want G7 to run with.

- Third, as I already mentioned, it trades all 7 of the major Forex currency pairs. This helps create balance so that if one pair goes bad, there are others to help things out and keep your account positive.

Track-Record

I'll start out showing you my results thus far, and then we'll go over some of the extensive back-testing Blue Edge Financial has done.

*Note: I started out with a demo account for the first week or so, but didn't record the results. Below are my real results with real money...

My Results

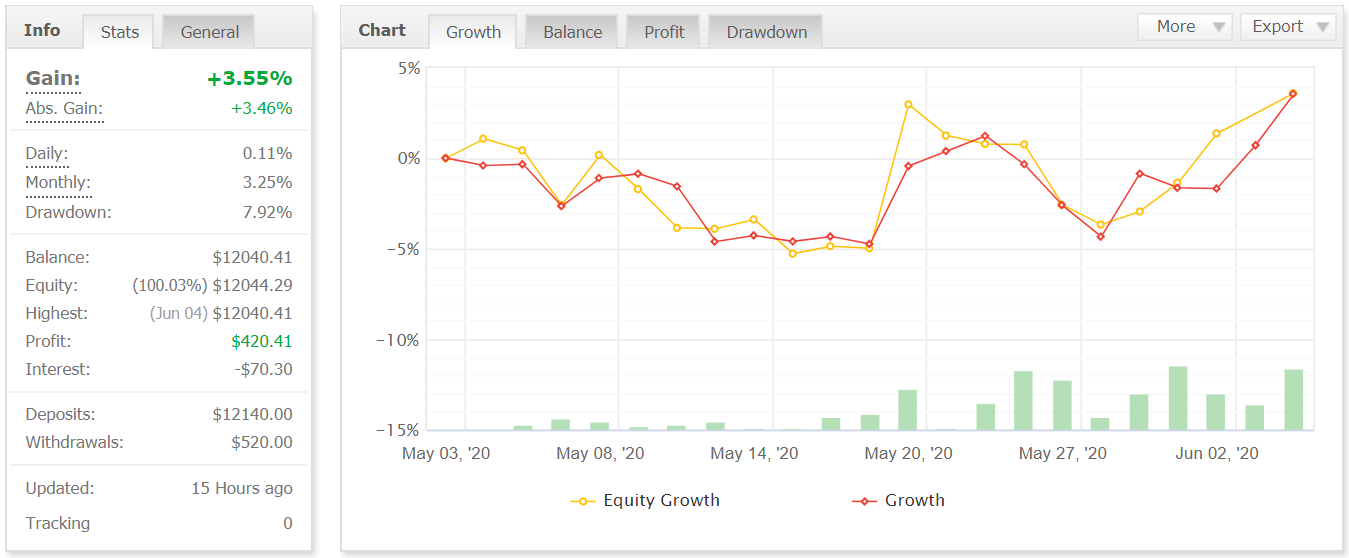

Month 1 (May 3rd - June 4th, 2020):

- Overall Growth: +3.55%

Well, my first month is already up and I made a 3.55% gain. This isn't all that amazing, but considering what has been going on with covid-19 and the economic impact this has had, I'm thankful to see any positive numbers. At the beginning of the month I was down some money, nearly 5% at one point, but by the end I had some profit.

Month 2 (June 4th - July 4th):

- Overall Growth: -13.3%

Well... this month was pretty disappointing. G7 went from positive growth to negative... pretty far negative. I also added funds to my account during this period so I lost more than I would have.

That said, the results are still within the results of the extensive backtest for G7, so at this point there is still nothing to be too worried about and I'm going to hold strong.

Back-testing Results All the Way to 2004

Blue Edge Financial certainly didn't skimp out with the back-testing. They have extensively tested G7 all the way back to 2004 (link to results here).

This particular backtest they ran at a 0.01/$500 fixed lot size, and I believe this was starting with just a $1,000 account.

The results... 40.83% average monthly gains. Yes, that is per month, not year. Pretty incredible to say the least, and that was with a max drawdown of 66.40 and max potential risk exposure of 101.32%.

However, normally they recommend setting G7 at 0.01/$1,000 fixed lot size. This is the default setting and it's less risky... which is what I've been letting it run at.

But even if you achieve an average of just 20%/mo... that's still great. Here's how it would go if you started out with a $1,000 account and made a 20% gain each month:

- Month 1: 1000 + 20% = 1200

- Month 2: 1200 + 20% = 1440

- Month 3: 1440 + 20% = 1728

- Month 4: 1728 + 20% = 2073.6

- Month 5: 2073.6 + 20% = 2488.32

- Month 6: 2488.32 + 20% = 2985.98

- Month 7: 2985.98 + 20% = 3583.18

- Month 8: 3583.18 + 20% = 4299.82

- Month 9: 4299.82 + 20% = 5159.78

- Month 10: 5159.78 + 20% = 6191.74

- Month 11: 6191.74 + 20% = 7430.08

- Month 12: 7430.08 + 20% = 8916.10

In this example, starting out with $1,000 and letting it compound with a 20% gain each month, the result was $8,916. That's almost a 900% gain within a year.

Now of course past results don't ensure future results, and there is no guarantee you'll make anything, but I think this scenario isn't far-fetched at all considering their back-testing results. Even just 10% a month would be good.

Cost

To get access to Titan G7 you need to purchase a Blue Edge Financial membership.

This isn't cheap, and costs $147 a month.

However, the profits can easily cover the cost. Having as little as $1,000 to start out with can be worth it.

Setting It Up

I'm not going to go into a lot of detail here because once you join there will be video tutorials taking you through the entire process. But I'll give an overview.

Step 1: Join Blue Edge Financial

Step 2: Open a Brokerage Account

They will recommend a good one with low spreads that works well with the software. You can also use an existing account if it supports the MT4 platform.

Step 3: Connect Your Broker Account to Blue Edge Financial

This is simple and consists of nothing more than entering a number.

Step 4: Get a VPS Service

You'll need a VPS (Virtual Private Server) to keep the software running all the time. This is cheap and easy. Mine only costs $8/mo.

Step 5: Connect MT4 to Your Broker

This also consists of nothing more than entering a number.

How to Get Started Risk-Free

You will be able to start using Titan G7 with a demo account through your broker. This means you'll be able to see real results but without risking real money (or you can just get started with a live account right away if you want).

Even the team at Blue Edge suggests getting started this way, and of course there are video tutorials showing how to go about setting it all up.

So there is no money being risked in the actual trades, and on top of that there is a 30-day money-back guarantee on the Blue Edge Financial membership cost if you are not satisfied.

This means it's virtually risk-free to get started.

Pros v Cons

Pros

- Automated trading

- Great track-record with extensive back-testing

- Manages risk effectively

- Trades in the largest market there is (Forex)

- Doesn't require any maintenance really - just set it and forget it kind of thing

- Demo account available & 30-day money-back guarantee on Blue Edge Financial membership

- Video tutorials walk you through entire setup

- Good support team with live chat available (didn't mention this, but very good)

Cons

- Membership price fairly high (although it can easily be worth it)

- Need money to invest to get started (of course)

- Risk involved (as with any investment opportunity)

Who It's Best For

There isn't really a type of person this is best for. Since it's a no-maintenance auto-trading software I'd say it's good for anyone looking to make some money, which I'd assume is just about anyone out there.

You will need money to invest to get started, but even starting out with $1,000 can be worth it. Some people even start with less than this.

Final Thoughts - Worth a Try?

I rarely recommend different systems/programs for making money. In fact, there are only a handful I recommend here on my site, and Blue Edge Financial's Titan G7 is definitely one of them.

My suggestion: Join Blue Edge Financial and test it out for yourself.

As mentioned, you can start with a demo account and they have the 30-day money-back guarantee, so you don't have much to lose.

Leave me any comments/questions below. I'll get back to you as soon as I can 🙂

i cant understand , if you lost 13.3% in the second month , this is not the robot for forex, i do not need to test,

Javier, there is not a bot out there that is going to be profitable 100% of the time. This is just how it works. -13.3% in a month isn’t bad. It’s still within the backtest results, which overall did extremely well. So at this point I’m not too worried… not yet.

What has it done since July?

Hello I'm Vic, I've been going over your content on the course, & am interested. However I've got a couple questions.

First is I'm a newbie at this so I'm completely lost where to start.

I've started thru a couple course's before and pad the fees. They said they would show me step by step how to get started, Take me by the hand and do the process. However when it came to the part of navigating thru a platform to place buy and sell orders, stop loss ,trailing stop loss, alerts ect, I didn't have a clue how to do this.

So I was stuck, and when I asked them time and time again, for help to learn this, it was like I was bothering them, they wouldn't take the time to show me how to do this. Mind you know, I paid the fee for the course expecting to learn this during the course. They said I was supposed to know this already. So their sales pitch was definitely misleading.

Cause they did not show me how to navigate a platform, set up charts ect. I wasn't raised with computers in school. So I'm not tech savvy,so to speak. They took the fees and left me hanging,

So my question to you is ,will you show me how to navigate thru a platform to trade properly, as stated above.

I'll be looking forward to your response. Thank you for your time.

Have a good day.

Vic R