How great would it be if we were paid to live our lives? We spend our hard earned money on food, hotels, retail stores, etc. If we aren't getting any discounts, there's got to be another way! Well, since you're here, you know there's an app out there who will give you a portion of what you paid for in every store.

Many are already subscribed to their program; but is the Dosh app safe? Read on.

Overview

- App Name: DOSH

- Website: dosh.cash

- Type: Cash back app

- Cost: Free to use

- Availability: For Android & IOS devices

What Is DOSH?

Dosh is a free mobile application that gives you cashback whenever you purchase a product or a service from their partner stores. If you're done with clipping coupons, a shopaholic, or just have this fear of missing out, they actually - sort of - reward you for it. It gives you lesser guilt too, especially when you're trying to save up.

Want to hear the best part? It's very simple to use. Yes, but safety is a concern for some and that's normal. Don't worry, we'll discuss each of them in detail soon.

How It Works

Setting up an account with Dosh only takes a few clicks and there's nothing complicated in there too. Just link the credit card you always use at the cashier or front desk then you're good to go! Plus, you get an instant $5 for doing that too!

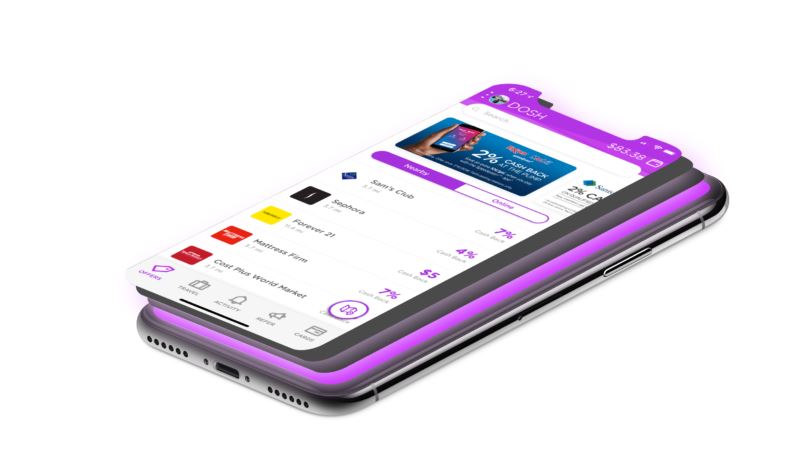

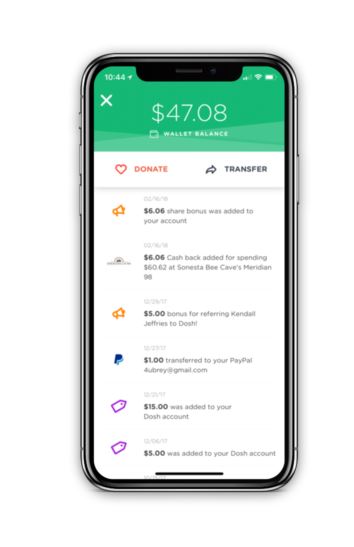

Once you're registered, you can view the stores you can buy from that will give you cashback. Now you go to the location, pay using your linked credit card, then receive the cashback. The percentage you'll get differs for every store but the average is between 2-10%. When you finally get at least $25, then you can cash out your money from the Dosh app to your PayPal, Venmo, or even bank account.

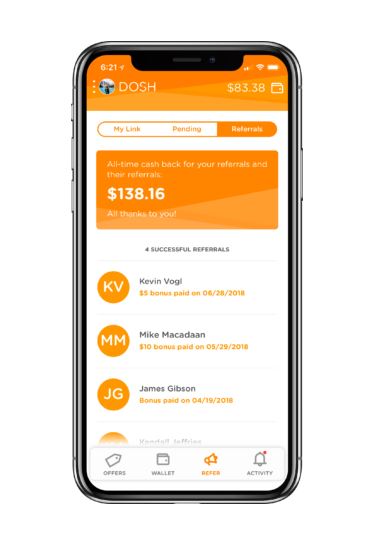

Now that's easy money, right? Well, Dosh can make it easier for you. If you refer your friends, you get $5 more for each of them who signed up. They get the starting $5, too! Seems like a win-win situation. Fairly easy, all they need is a little convincing or you can just show them how it's done!

Take note: Dosh gives you cashback with real cash. No points or coupons to worry about.

Security

The biggest question: Is it safe to link our credit cards to the Dosh app? According to their website, they care about their users' data and information. They claim to have a Bank-Level Security. However, we have to take into consideration that most companies who require your payment information say that too.

There are times when we transact with unethical businesses and individuals. They get our personal information but they openly sell these to other companies. Yes, they do exist and things like that happen. It's honestly difficult to tell but it's best to be cautious and aware.

Here are the things that come with their Bank-Level Security:

They claim to have Data Safeguards which means that they do not store any information on their servers. This stresses their argument that they can't sell information to third-party because they technically don't see real data themselves.

Basically, what they do is they tokenize and vault your credit card information. In simple terms, your card digits are replaced with something else. Plus, they're storing it on another server. Here's an example:

Your card number: 1234 5678 9101 1121

What they have on the servers is: AKG8 WR7T JLHA 7HB3

It is totally different from your real number but their system considers that as valid. It's randomly generated and sent to another server so they don't have any means of decoding it too. The other server has no way of knowing that the generated key is a credit card information.

Then, if you're using and trusting of PayPal, they do have the same payment system provider which is Braintree. Now the security of Braintree calls for another topic but it's pacifying to know that they're using a service that big guys use.

Next, since we have sensitive information on our phone, the last thing we want is unauthorized access. The thing is: what if we lose our phone? That idea may be far-fetched but it can happen and it does happen.

Unlike your other secured app where you're exercising 2FA, the Dosh app takes it a level higher and uses Multi-Factor Authentication (MFA). Basically, that is more than just having 2FA because since you lost your phone, you lose your number too. If your 2FA happens to be sent via SMS, you're not 100% safe.

Remember: you have money waiting for you in the Dosh app. If someone else is able to transfer it to their own accounts, you lost the opportunity to benefit from your cashbacks!

If you're trying to figure out what MFA is, imagine this: you can require your fingerprint to be scanned before you can open the Dosh app. When you get in, Dosh app sends a verification code to you before you can fully access the app. Now that's more secure; and guess what, PayPal does that too!

What can we say? So far, we're safe.

Use of Card

Now that we've established how secure their app is, if you're like us, we still have to ask:

Why do I need to link my card?

All is fine, don't worry. They need the card to track your usage. If you pay at a participating store, they will know and be able to identify the amount of your purchase. Then they give you a percentage of what you paid for back to the Dosh app!

How to Get Money

So we've already covered most of the sketchy facts. Right now, you might be wondering what will happen next after you've made some purchases. You may be noticing that your balance is increasing by a few dollars or cents. As mentioned earlier, once you've reached at least $25, that's when you can start getting back your cash - literally.

Yes, you read that right. Only when you've saved up $25 will you be able cash out. Provided you've reached that amount, you can withdraw money via PayPal, Venmo, or your bank. So be sure to link your accounts from there too!

If you're thinking whether registering in this app is worth the cash back, let's do some math:

As soon as you're registered, you instantly have $5. So now you're only going to think about where to get the remaining $20, let's get to each of them:

Cashback

As mentioned, the average percentage ranges from 2% up to 10%. To set our expectations, let's compute using the least rate which is 2%. Say you're ordering from Sephora and want to go for Free Shipping. Minimum you will pay is $50. If we're going for those figures, for every $50 you spend, you get $1 back.

Yes, just a dollar. Imagine if you were purchasing something of smaller value. In this case, you need to spend at least $1,000 to get the $20 differential so you can withdraw money from the Dosh app.

Referrals

Dosh gives you $5 for every successful referral. Those who actually sign up and link their cards. You can withdraw money without spending any cash. Sounds like a deal! Remember, we just need $20 more; meaning you will just have to make 4 of your friends to link their cards. That's easier money!

Pros & Cons

Looking at the bigger picture, let's look at the pros and cons of the Dosh app. It's good practice to always look at both sides of each coin so you know what you're getting into!

Pros:

- Wide variety of participating stores

- In the scenario above, that was just talking about Sephora. The good thing about the Dosh app is that they were able to partner with a lot of partner stores including: Dunkin' Donuts, Sam's Club, Jack in the box, Payless, edible arrangements, etc. So if you frequent those stores, maybe it's best for you to sign up!

- No need to change payment method

- When you sign up for these programs, some of them would require you to pay via their loyalty card, your phone, or an app. That's not efficient because sometimes we forget to do bring it out at the cashier. With Dosh, just pay like you normally would. That's great!

- Quick Cashback & Cashout

- Other apps who have similar programs take a while to credit cashback and to give you your cashback. Some programs offer points or gift cards instead. Dosh is stepping up the game by crediting your cashback within an hour after each transaction. Plus, when you withdraw, it just takes them a week to give your money!

Cons:

- Not all store locations participate

- It's cool that Dosh has partnered with a lot of the big brand stores you would usually shop in. However, not all store locations participate. For example, Pizza Hut from downtown has partnered with Dosh but the Pizza Hut near you hasn't. If you want to be credited cashback, make sure to ask the clerk if they're with Dosh app.

- Only available in the US

- If you're a jet setter, you might be surprised that your purchase from Bed Bad & Beyond in another country isn't being credited in your Dosh app. That's because Dosh app can only track the transactions you made in the US.

- Can't use cards that are linked to competitors

- If you're big on cashback or other loyalty programs, this can be disappointing because if you have previously signed up to one of Dosh's competitors using your card, you can't link that card anymore to Dosh. You might need to get a new card now...

What Users Say

Now that we've uncovered most of the important details, it's time to hear what Dosh users have to say. They've already been there so it's good to hear them out.

According to the early users of the Dosh, the system was great. They liked the idea of receiving cashback for their usual purchases. They find the app to be flawless and the transactions seamless. That was when they were in their early stages...

As the community grew, more recent reviews reflect that the crediting of cashback started to slow down and even more so when giving cashing out. Some participating stores have ended their partnership with Dosh which leads to confusion when it comes to expected cashbacks. Especially if you were used to getting cashback from that specific store.

If you want to read something juicier, you might want to scroll down on the comments section of this article. You will be shocked!

The Verdict

Technically, Dosh app is legit and they do have a system that works. However, we say that the startup may not have the best interest of the consumers. Yes, they do claim that you can earn money just by shopping but if you're thinking the app is built for you, you're wrong.

Dosh has a Business 2 Business (B2B) model which means that their main customers are those big brands. Not you. As a matter of fact, they openly claim that their subscribers are proven to spend more and return more frequently. So whose benefit is it, really?

Our main say is that they deliver on their promise which is cashback. They're safe too, if you're still wondering.

Earning Potential

If you're thinking about your earning potential in using Dosh - there's not much. In fact, it's not totally considered an earning.

This is certainly not an app that will generate you money. Instead, it just gives you incentives, in cash. You do have to pay first though. However, we still think it's worth downloading. It doesn't require you to do anything but shop. It takes no extra time too, especially if you already love shopping, dining out, and traveling!

Fair warning though:

Don't use Dosh to validate your spending! You're more on the losing end if you do. If you're always ordering something from Walmart, for example, then that's fine. However, if you're going to another store to purchase something and think, it's okay to spend because you're getting cashback anyway, don't do it.

PS: If you were reading this because you're looking for extra income, this article is what you're looking for. 🙂